Part Two: A CBU Revisit

A couple of years back, I shared an article in which we explored the price discrepancy between CBU imports by the local assemblers, especially the old Japanese big three, and what those same CBU imports cost in other countries around the region. Suffice it to say, we saw that the prices in Pakistan were, at that time, over and beyond what any other country was paying for these CBU imports. So, let us see where things stand currently:

1. Toyota Land Cruiser

The Land Cruiser is the SUV that is considered the ultimate Luxury in the local market. However, you would be hard-pressed to find it on any list of luxury SUVs in the Western world. Believe me. I have looked.

Related: Huge Imbalance in CKD vs CBU Pricing

The last time we explored the price of the Land Cruiser, it was sold here locally by Toyota Indus for the price of PKR 526.5 lac. In other nations like the Philippines and Vietnam where it was/is also a CBU import, it was sold for far less. At that time, the CBU Land Cruiser sold in Pakistan by Indus Toyota was about twice higher in price than it was in Vietnam and about three times higher than it was in the Philippines. Here is the old price table to get an idea:

| Country | Vehicle Name and Model | Sale price in countries where it is imported |

| Philippines | Land Cruiser LC 200 Premium | PKR 15.97 million (PKR 159.7 Lac) |

| Vietnam | Land Cruiser | PKR 27.97 million (PKR 279.7 Lac) |

| Pakistan | Land Cruiser VX A/T Petrol | PKR 52.65 million (PKR 526.5 Lac) |

Fig 1 – The old comparison list (2021) (Note: Variant names vary depending on country. Specs of variants are the same or similar.)

Now let us see where the current prices lie. We will compare the same countries again i.e., Pakistan, Philippines, and Vietnam. To do so, first, let us look at the prices of the vehicles in each country in their local currency currently. Then we will convert it to PKR at May 1st, 2023 rates to get a better idea.

- Toyota Land Cruiser ZX price in the Philippines = 5,732,000 Philippine Pesos

- Toyota Land Cruiser price in Vietnam = 4,286,000,000 Vietnamese Dong

- Toyota Land Cruiser price in Pakistan = PKR 156,829,000

| Country | Vehicle Name and Model | The sale price in countries where it is imported (Conversions rates used – 1st May 2023) |

| Philippines | Land Cruiser ZX | PKR 29.24 million (292.4 Lac PKR) |

| Vietnam | Land Cruiser | PKR 51.715 million (517.15 Lac PKR) |

| Pakistan | Land Cruiser | PKR 156.829 million (1568.29 Lac PKR) |

Fig 2 – The current situation (2023) (Note: Variant names vary depending on country. Specs of variants are the same or similar.)

To say that the price difference is ‘mind-bending-ly’ staggering, will be the ultimate understatement. This time around the price difference is overwhelming. The average difference now is over 1000 Lacs PKR (10 Caror PKR) between Pakistan and the other two nations. The land cruiser sold in Pakistan is around 3 times more expensive than in Vietnam and more than 5 times as expensive than it is in the Philippines.

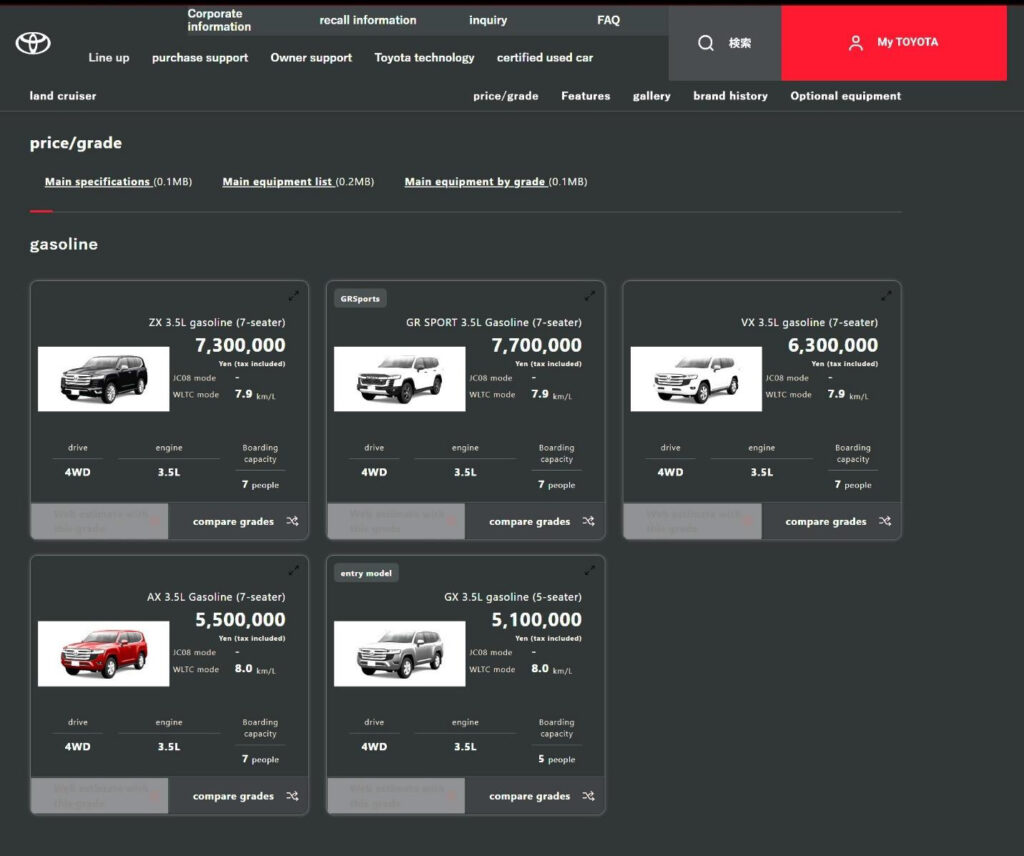

If the justification for this extreme price in Pakistan is down to very high taxes, then that is where the argument falls apart. Let us look at that high tax rate and see if that is really the cause. The going argument is that in Pakistan the taxes on luxury SUVs like the Land Cruiser have increased to 500%. As we all know, the Toyota Land Cruiser is imported directly from Japan, where its pricing is as follows:

The above prices for the Cruiser ZX are the Japanese market prices. The market price is the sale price of the Land Cruiser in Japan. This would include the company manufacturing cost, company profit, showroom/dealer profit (in Japan), and applicable government taxes on the vehicle.

Indus Motor Company (IMC), when acquiring the Land Cruiser, will be doing so by getting a Dealer Discount. That means the taxes for local sales will not be applicable and the local showroom/dealer profit will also not be applicable. And, again, because IMC is a subsidiary of Toyota Japan, it will presumably receive a special reduced/discounted rate from Toyota Japan. This is a very important point. As we don’t know what the exact dealer discount price is, I will continue with this example by using the higher, Japanese market price.

- The market price of the Land Cruiser in Japan = 7,300,000 Yen = PKR 15,112,166 or PKR 151.12 lac

- Tax applicable on the import of the Land Cruiser = 500% = 15,112,166 x 5 = PKR 75,560,830 or PKR 755.61 lac

- Total Amount for vehicle cost and tax = 15,112,166 + 75,560,830 = PKR 90,672,996 or PKR 906.73 lac

Here we will also need to add another cost encompassing freight/shipping costs, handling/clearance costs, company overheads, and local shipping to the concerned dealerships. As we don’t know that clearly, let’s add the obscene maximum cost of PKR 100 lac or Rs 1 crore to cover all the basics. That would mean:

- Freight/ shipping costs, handling/ clearance costs, company overheads, and local delivery to the concerned dealerships by IMC = PKR 10,000,000 or Rs 100 lac

- Total Cost of Land Cruiser = 90,672,996 + 10,000,000 = PKR 100,672,996 or PKR 1006.73 lac

So, the Land Cruiser costs the company around PKR 1006.73 Lacs (Rs 10 crore 6.7 lacs) to import and display in their showrooms; and here in lies the issue:

| Cost of Land Cruiser | Local Sale Price of Land Cruiser | Profit Margin |

| PKR 1006.73 Lac | PKR 1568.29 Lac | PKR 561.56 Lac |

This means IMC charges over Rs 5.5 crore in pure profit for the Land Cruiser. Which renders that only the profit is around 372% of the original purchase price of the Land Cruiser from Japan. And this is made worse by the fact that we have been working using the market prices from Japan and not the much more discounted dealer prices that Indus Toyota would enjoy. In those cases, their profit margins become even more insane.

We must also keep in mind that, of the original Japanese purchase price (7,300,000 Yen/ PKR 151.12 lac), only a small fraction is profit for Toyota Japan. That price includes material costs, manufacturing costs, applicable taxes, etc. But looking at the insane amount that is charged as the profit margin only for the Land Cruiser in Pakistan, no wonder Pakistan is a “valuable business partner” for these companies. The profit that is earned from the sale of even one CBU imported Land Cruiser in Pakistan is equivalent to the profits earned from the sale of dozens of Land Cruisers in the Japanese market. It is a mind-boggling realization.

2. Toyota Camry

The same is the case with the other imports as well such as the Camry Hybrid. Besides Pakistan, it is imported into the Philippines, Vietnam, and Indonesia as well. The Camry, I believe, is imported from Thailand as it is manufactured there as well besides Japan, the US, and China.

- Toyota Camry Price in Philippines: 2,402,000 Philippines Peso.

- Toyota Camry Price in Vietnam: 1,495,000,000 Vietnamese Dong.

- Toyota Camry Price in Indonesia: 909,400,000 Indonesian Rupiah.

- Toyota Camry Price in Pakistan: PKR 53,859,000

| Country | Vehicle Name and Model | Sale price in countries where it is imported (Conversions rates used – 1st May 2023) |

| Philippines | Toyota Camry Hybrid | PKR 12.25 million (PKR 122.5 Lac) |

| Vietnam | Toyota Camry Hybrid | PKR 18.04 million (PKR 180.4 Lac) |

| Indonesia | Toyota Camry Hybrid | PKR 17.567 million (PKR 175.67 Lac) |

| Pakistan | Toyota Camry Hybrid | PKR 53.859 million (PKR 538.59 Lac) |

(Note: Specs of vehicles are the same or similar.)

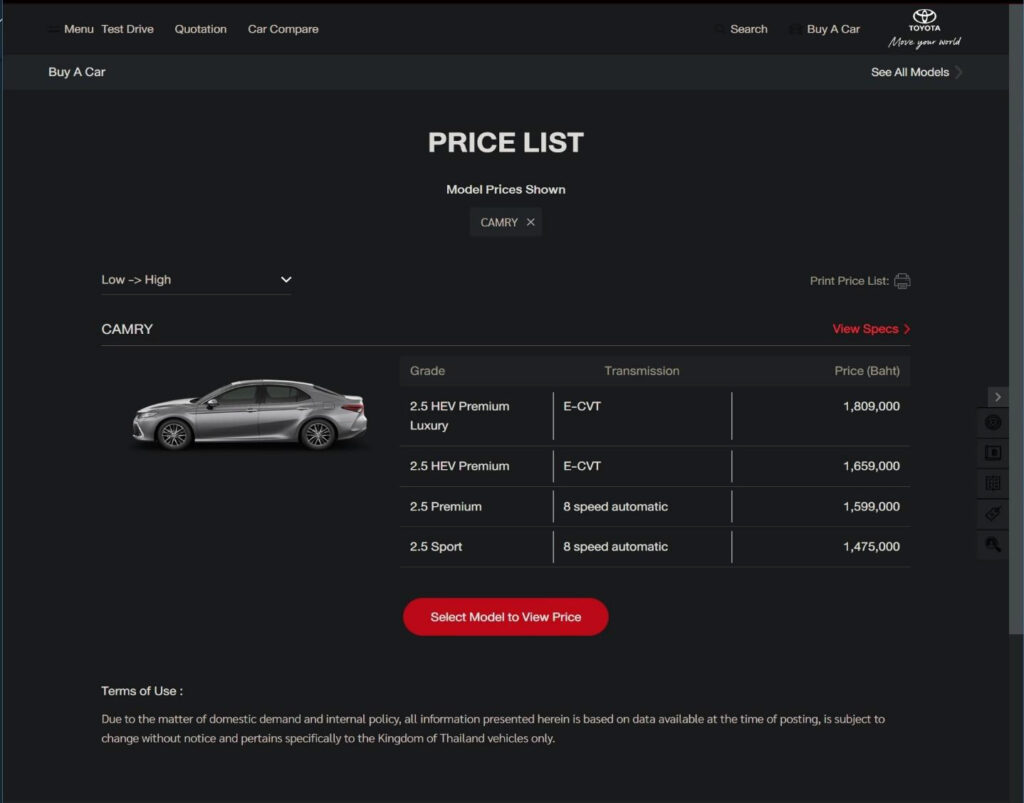

Again, the price differences are mind-bending. Just as we saw with the Land Cruiser, the Camry in Pakistan is also nearly 5 times higher in price than it is in the Philippines and is also about 3 times higher in price than in Vietnam and Indonesia. Below is the market price list for the Camry in Thailand. It should be noted that the Camry which is imported into Pakistan has fewer options when compared to the Hybrid “Premium” and “Luxury” trims available in Thailand.

Here, again, we have a case similar to the Land Cruiser. Again, these are the market prices in Thailand. When Toyota Indus imports one from Toyota Thailand, it will be getting the Camry through a substantial dealer discount. Thus, again, we have a vehicle that costs very little to import into the country. However, unfortunately, by the time the local company is done with it, it costs crore of rupees more.

This is the case for all legalized imports by the local assemblers. I will not go into anymore because it will just get too long. I believe these prominent examples have made the point vividly. From what has been stated in this and the previous part of this four-part opinion piece, we can see a clear picture emerge; and it’s not very rosy. We are finding the answer to our original question, are we being treated fairly?

Related: How Not to Launch New Cars in Pakistan

In the next part, we will be looking at some of the alibis from these local companies and their actual worth/importance to our local market.

Contributed by: Muhammad Ali Khan– A guy who is passionate about cars and concerned about the state of the auto sector in the country.

Read other articles in this series:

CarSpiritPK welcomes Guest Posts. If you have the ability to generate quality content and can write some relevant and useful piece of information to be shared with our readers, feel free to contact us at: [email protected] Send you emails titled as (Guest Post submission)