Production and sales of locally assembled vehicles paint a very depressing picture for auto assemblers as the market continues to shrink and demand for new vehicles remains subdued.

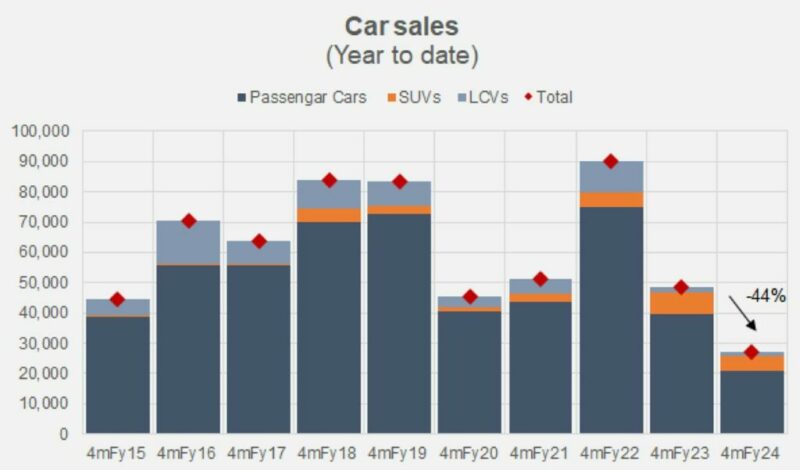

October 2023 turned out to be one of the worst in terms of single-month sales, whereas data released by PAMA (Pakistan Automobile Manufacturers Association) show that the production & sales figures came down by 53% and 44% respectively as of the first 4 months of this fiscal year. Not to mention, these figures are just half of the already dented figures from the same period in FY23.

Moreover, CKD imports by local assemblers also hit an alarmingly low to just $23 million in October from $54 million in September 2023, rendering a 58% month-on-month decline. It’s the lowest in 45 months indicating there will be a continued and marked decline in volumes over the next few months as dominant factors for the decline persist.

Related: Dismal Production Numbers: A Closer Look at Local Assemblers’ Performance

Ming boggling prices of locally assembled new cars, coupled with stringent auto financing conditions & high-interest rates (which stand at a whopping 22% compared to 7% from a couple of years ago) resulting in unrealistic monthly installments, as well as high fuel costs, and reduced purchasing power of the masses due to worsening economic circumstances, have all contributed towards a massive decline in demand for new cars.

The automobile market has decreased sufficiently to its two-decade-old size. At the current rate, the industry will sell approximately 81,000 units in the whole of FY24 (PAMA member companies), which is less than the 20-year average annual sale number of 174,000 units. It can still go beyond the 90k mark if we add sales of non-PAMA members including Changan, Kia, and DFSK. Still, less than 100,000 units in a year for the entire auto industry is nothing but a very depressing number.

Related: Affordable Cars – The Foundation of a Thriving Auto Industry

Interestingly, only two years ago, in FY22, the market reached an all-time high in terms of volume, even breaking the 300,000-unit barrier (including non-PAMA members) for the first time. Only serves to highlight how drastically things have changed since then.

But even more interestingly, when production & sales numbers are cut in half, local assemblers are still enjoying ample profits as reflected in their financial statements. Despite lower sales, the profit-after-tax of Honda Atlas Cars clocked in at Rs 675.34 million in the second quarter (July-September) of its fiscal year 2023-24.

Related: Despite 55% Decline in Sales, The “Big 3” Enjoy 82% Surge in Revenue

Indus Motor Company (IMC) the assemblers of Toyota cars in Pakistan reported a profit of Rs 3.22 billion for the quarter that ended September 30, 2023, an increase of a staggering 148% when compared with earnings of Rs 1.3 billion in the same period of the previous year. Pak Suzuki, which recently announced delisting from the Pakistan Stock Exchange (PSX), reported a profit after tax of Rs 3.8 billion for the quarter ending on September 30, 2023.

As the market continues to shrink and the masses suffer from depleting purchase power, automakers continue to launch super-expensive offerings targeted purely toward the affluent & elite class. Hyundai-Nishat recently introduced the new Santa Fe hybrid which is priced between PKR 1.3 crore and PKR 1.47 crore, and the company was able to enjoy sales of 175 units of these in the first month of launch. For reference, sales of Suzuki Wagon R stood at 197 units in the same month (October 2023).

IMC is also gearing up to launch the Corolla Cross hybrid which will also be likely priced above the Rs 1 crore barrier. Plus, Sazgar’s highly profitable foray with expensive Haval SUVs is a great example of how low numbers of expensive vehicles benefit businesses but not the country’s auto industry in terms of volumes.

Related: Cars Sales in India & Pakistan Becoming Poles Apart

From the looks of it, the market will continue to shrink & the volumes will keep plummeting, but because of excessively pricier offerings, the profit margins will remain unaffected. This also means that while those having expensive SUVs and luxury cars in their portfolio can sustain the damage, those relying on selling smaller & mid-range cars for the masses will suffer in the near future as analysts predict up to a further 14% decline in production & sales numbers by the conclusion of FY23/24 in June 2024.

A computer animation professional with over 23 years of industry experience having served in leading organizations, TV channels & production facilities in Pakistan. An avid car enthusiast and petrolhead with an affection to deliver quality content to help shape opinions. Formerly written for PakWheels as well as major publications including Dawn. Founder of CarSpiritPK.com