We have already written extensively about why local automakers, particularly new entrants, are happy to introduce extremely pricey SUVs during the toughest of economic conditions, despite the fact that the general public is seeing a steep decline in purchasing power. Simply because it provides thicker profit margins against selling a relatively small number of units in comparison to selling volumes of mass-market budget cars that come with the hassle of providing quality after-sales service to a large number of units.

The example of Sazgar is a perfect illustration of what was said above. The company which is best known for selling three-wheel rickshaws has seen a dramatic change in its financial state ever since it started selling pricey SUVs. Some incredibly startling information has been shared by Business Recorder.

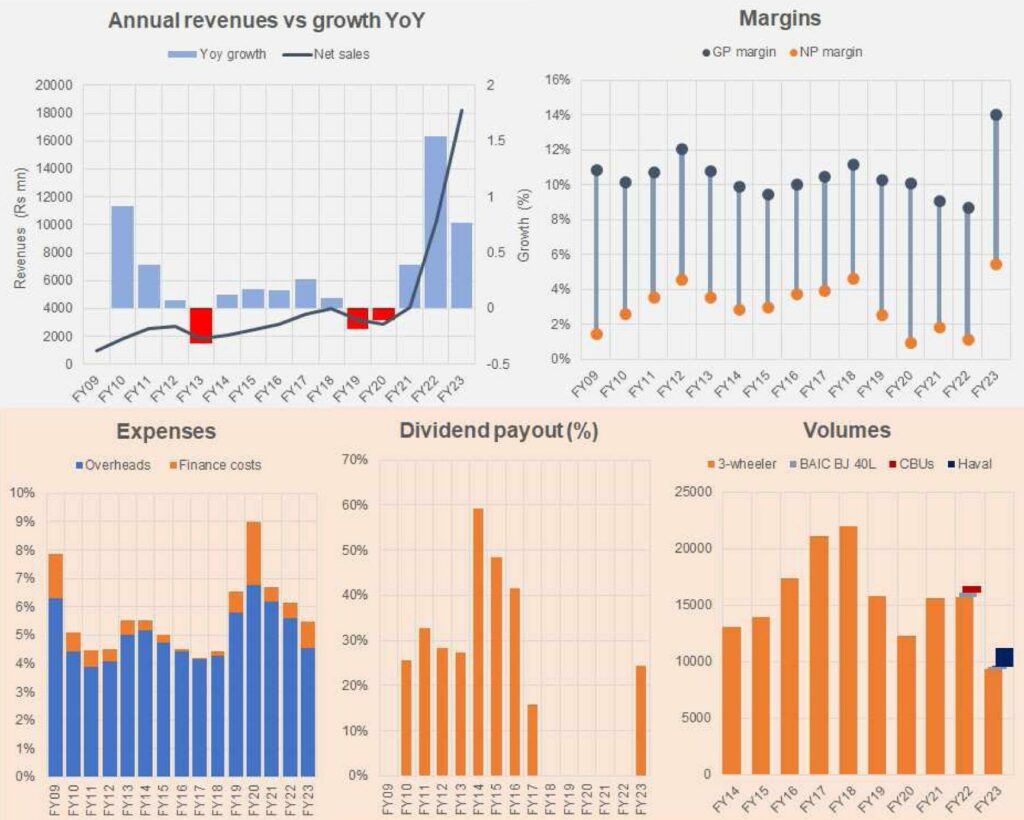

Following Auto Policy 2016–21, Sazgar made the decision to venture into the 4-wheel business and teamed up with two Chinese automakers, BAIC and Haval, to assemble their vehicles locally. The move is paying off, particularly since the introduction of Haval SUVs. After a 5-year break, Sazgar paid out a healthy 24% dividend to stockholders during the outgoing year.

Since entering into the 4-wheel business, sales of about 1,800 four-wheelers, of which exactly 1,657 units belonged to Haval, drastically transformed the company’s fortunes. Despite selling more than 15,000 rickshaws in the past year, 55% of the company’s revenues came from just 997 four-wheelers. The distinction has been more pronounced in FY23. Over 80% of the year’s revenues came from four-wheelers, which implies the remaining 20% was made up of about 9,000 rickshaws and 37,500 tractor-wheel rims.

With Haval on board, Sazgar’s revenues increased by 77% in FY23, despite the fact that the economy is in disarray and the auto sector is rapidly consuming the dwindling pie. There is no disputing the shift to Haval was the right one when examining the gain of 39% in four-wheeler income per unit sold between FY22 and FY23.

While Sazgar’s diversification into new markets, such as SUVs has benefited the company, its other markets are too small in comparison and are not profitable enough. According to the company’s annual report, it exports three-wheelers to Afghanistan, Japan, Ethiopia, Qatar, and Marutiana. Despite this, FY23 revenue declined by nearly 40%.

In recent years, there has been a widespread belief that Pakistan is/will experience a natural transition from sedans to SUVs, as the rest of the globe has. This is why so many new players have joined the SUV bandwagon and succeeded—from Kia to, undoubtedly, Sazgar—the financial gain made from SUVs is truly mouth-watering. Meanwhile, manufacturers of small automobiles, such as Suzuki, are struggling. Because the market is so limited and market shares are so modest, volumes of small automobiles are just insufficient without economies of scale.

Meanwhile, a vehicle like Haval (available in petrol and hybrid versions) costs between Rs 9.5 million and Rs 12 million—in comparison a Sazgar’s 9-seater rickshaw costs a minuscule fraction, or around 9% of the SUV’s price.

There are a lot of ifs & buts regarding the SUV boom though. A significant shift to SUVs would be dependent on many factors such as income growth over the next few years, how affordable and accessible bank financing becomes, and, most importantly, whether local roads and infrastructure can bear the burden, and thus the cost to public expenditure, that these large & expensive vehicles will incur.

Related: The Expensive Crossover Conundrum: A Closer Look at Automaker Priorities

More importantly, do the current SUV sales represent or even indicate that the SUV shift is taking place? Pakistan’s annual vehicle production numbers have dwindled sharply in recent years, and it remains to be seen whether they can rebound to pre-crisis levels, if not improve much further. Nevertheless, Sazgar is enjoying a handsome profit on selling less than 2,000 units of its SUVs, which is noteworthy. A successful recipe that most automakers would love to try out in Pakistan.

Source: Business Recorder

A computer animation professional with over 23 years of industry experience having served in leading organizations, TV channels & production facilities in Pakistan. An avid car enthusiast and petrolhead with an affection to deliver quality content to help shape opinions. Formerly written for PakWheels as well as major publications including Dawn. Founder of CarSpiritPK.com