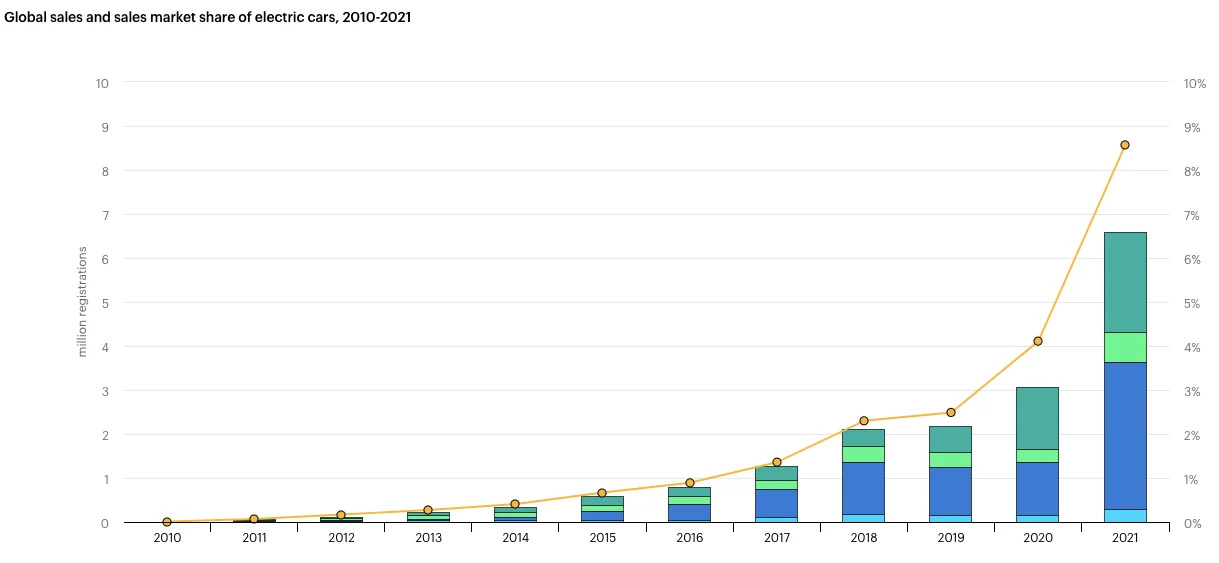

The global sales of electric vehicles (EVs) in recent years is growing at a significant rate, but has reached new heights within the last couple of years. According to a report by the International Energy Agency (IEA), electric vehicle sales have more than doubled from 3 million units in 2020 to 6.6 million units in 2021.

With this EVs have accounted 9% of the global passenger vehicle market in 2021, and nearly tripling its market share from two years ago. The significant growth in EV sales during the past three years has taken place during the pandemic, as auto manufacturers struggled with bottlenecks on their supply chains according to the report by the IEA.

Related: EVs in China are Cheaper by 47% Since 2011

The report also highlights the fact that EV sales in the top three markets were found to be stronger in the later part of 2021. Throughout last year, monthly sales of electric vehicles have been “consistently at least 50% higher” than the corresponding month in 2020. Around 16 million electric vehicles are now estimated to be on the roads globally.

China led global markets in terms of EV volume with 3.4 million sales in 2021, which is more than the volume sold around the world in 2020. This annual increase is the fastest EV market gain in China since 2015, and also outpaced the more gradual recovery of the overall passenger vehicle sales market, the IEA report says. In 2021, electric vehicles comprised of 20% market share in China in December, which was just 7.2% in January that year.

In Europe, sales of EVs grew to 2.3 million units, up 70% with around half of that figure comprised of plug-in hybrids. Overall, the European automotive market has yet to recover from the effects of pandemic, with overall vehicle sales in 2021 being 15% lower than that of 2019. According to IEA, the increases in EV sales in Europe was partly led by new stringent CO2 emissions standards as well as EV purchase subsidies that have been increased and expanded in most major European markets. Monthly sales of EVs in Europe last year was strongest in the final quarter, the peak arriving in December when EV sales outperformed diesel vehicle sales for the first time, with EVs taking a 21% share in Europe.

Related: Toyota CEO Akio Toyoda is Dissatisfied with Japan’s Push Towards EVs

In terms of markets by country, Germany was the largest in Europe for electric cars, the continent where “more than one in three” new vehicles sold in November and December were EVs. These accounted for 17% of total European sales in 2021, however there were significant differences between countries; as EVs comprised 72% of sales in Norway, 45% in Sweden and 30% in the Netherlands. Among “large European markets”, Germany had the largest EV share with 25%, followed by the United Kingdom and France, both with 15%, Italy with 8.8% and Spain with 6.5%.

In USA, electric vehicle sales got more than doubled from that in 2020 to surpass 500,000 units in 2021, according to the IEA. Tesla remains the largest EV player in United States, accounting for more than half of all electric vehicles sold in the market. Tesla however has sustained a drop in market share, as other automakers offered a growing range of new electric vehicles in USA.

Interestingly however, sales of electric vehicles in major markets – China, Europe and the United States – make up around two-third of the overall car market and 90% of EV sales, while most other markets see electric vehicles account for less than 2%. As per IEA report, large developing economies such as Brazil, India and Indonesia see an EV penetration of under 1% “without any significant increase” over the past year. These countries see growth in the electric scooter and electric bus segments, however the price premium for electric cars as well as the lack of charging infrastructure are cited as key reasons for the sluggish uptake.

Other developed economies in Asia show varied levels of EV uptake in their respective markets; Japan has seen the EV market share remain below 1% over the past three years, however Korea has seen EV sales more than double in 2021 with electrification gaining market share to 8%. Meanwhile, Australia witnessed more than triple the EV market share to 2% in 2021.

Related: BYD Wins Chile Lithium Extraction Contract for $61 Million

However there are challenges for electric vehicles compounded by price hikes for materials required in the manufacture of batteries, such as lithium carbonate which has gained 150% in price year-on-year, graphite by 15%, nickel by 25%, and more, the report added. Furthermore, in 2021 the price of steel grew by 100%, aluminum by 70% and copper by more than 70%, which affects the production of both conventional ICE and electric vehicles.

In a separate IEA report on the role of critical minerals in clean energy transitions, global markets potentially face a shortage of lithium and cobalt as soon as 2025 – just three years away – unless enough investments are made in order to expand production. This will require the speeding up of not just the extraction of minerals, but also of the entire EV value chain, this report said.

A computer animation professional with over 23 years of industry experience having served in leading organizations, TV channels & production facilities in Pakistan. An avid car enthusiast and petrolhead with an affection to deliver quality content to help shape opinions. Formerly written for PakWheels as well as major publications including Dawn. Founder of CarSpiritPK.com