According to a World Bank assessment, Pakistan’s state-owned enterprises (SOEs) have the worst performance in South Asia. These SOEs are a burden on a country that has been struggling to stay afloat.

With their losses threatening to submerge the nation, SOE’s earnings are like a man attempting to fill a bucket with drops. According to the Finance Ministry, 212 SOEs operate in various areas of the economy, and all of them are running with losses.

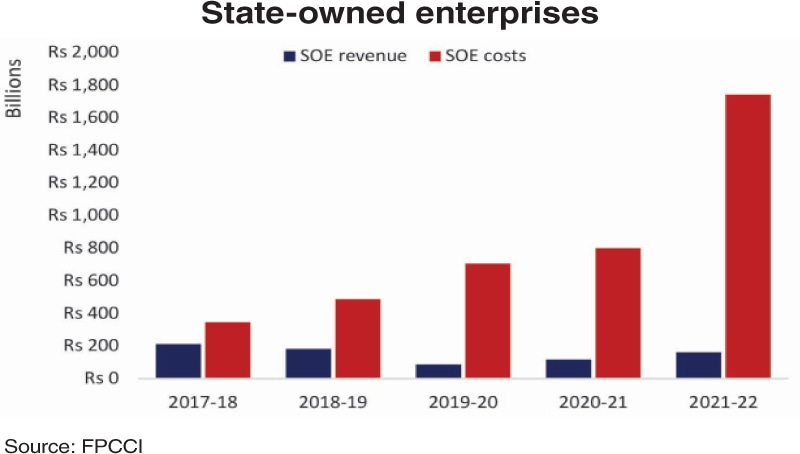

In recent years, the costs to the economy have risen steeply due to the substantial increase in the power sector subsidies, according to the research report “Impact of IMF Programmes: A Context of Pakistan” by the Federation of Pakistan Chambers of Commerce & Industry. The net impact of SOEs has climbed from 9.2% as a percentage of the budget to 46.2% in FY22 because of payments to independent power producers.

Though the energy sector’s inefficiencies have exacerbated the costs, the other SOEs also enjoy the government’s largess through subsidies, loans, and equity injections as direct support as well as issuing guarantees to allow them to secure loans from commercial banks.

That their losses are unsustainable is pretty obvious logic. SOEs are often used to park employees who enjoy government salaries and perks on taxpayer money. However, the International Monetary Fund’s coercion is forcing the government to reconsider its approach to governance.

The attempts to halt the bleeding have failed in the past, and they are not succeeding very well right now. Just because the government wants to sell doesn’t mean anyone is willing to buy.

Source: Dawn

Responsible for delivering local & international automotive news.