Following the company’s formation 20 years ago, Tesla’s route to becoming the leading producer of electric vehicles was paved in 2010 thanks to a collaboration with Toyota. A few years later, the partnership was broken, but Tesla, which is celebrating its 20th anniversary in 2023, acquired its first facility from Toyota as well as its knowledge of mass production.

Now 13 years later, Toyota is turning back to Tesla for manufacturing expertise. An executive overseeing production at the Japanese carmaker recently said “It’s finally come to the point for Toyota to learn from Tesla. It was a shock. But as things stood, they wouldn’t have been able to lower EV prices sufficiently. Toyota has reached the point where they needed to change production methods.”

In mid-June, Toyota revealed its new gigacasting technique, which uses aluminum casts to create large modules. It might be applied to Toyota’s next-generation EVs in 2026. Similar megacasting technology is already used by Tesla, despite being something ground-breaking for the Japanese automaker.

Related: Elon Musk of Tesla Eyes Significant India Investments After Meeting Modi

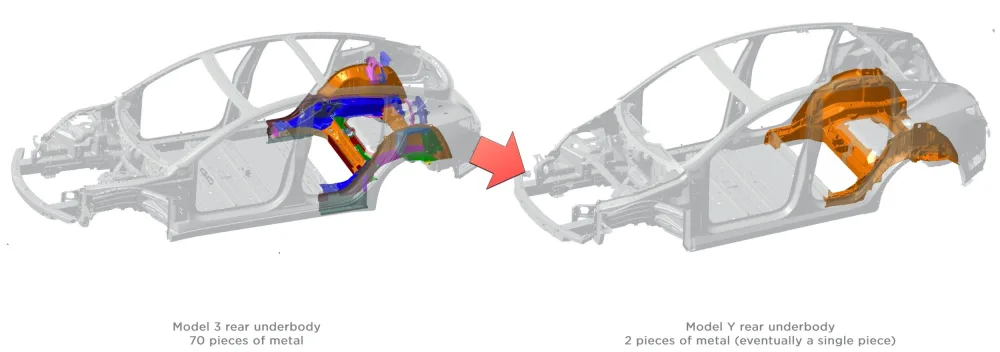

Using traditional production methods, an automobile body involves the welding of more than 100 sheet metal components. However, the vehicle’s body is made of just two sections thanks to Tesla’s megacasting, which employs substantial die-cast equipment. 2020 saw the introduction of the production method for Tesla’s Model Y and other models in the lineup, which helped to cut costs per vehicle by 50% on average. Although Chinese EV startups followed suit, Toyota had been seen as keeping its distance.

The vertically integrated supply chains of Japanese automakers would be undermined by a decrease in automobile components as fewer orders would be placed with suppliers. However, Toyota eventually gave up. According to a senior Toyota executive referring to that 2010 partnership said:

“At the time (2010), no one could have imagined that Tesla would become what it is now. Today Tesla is the market leader in EVs. We should learn from them.”

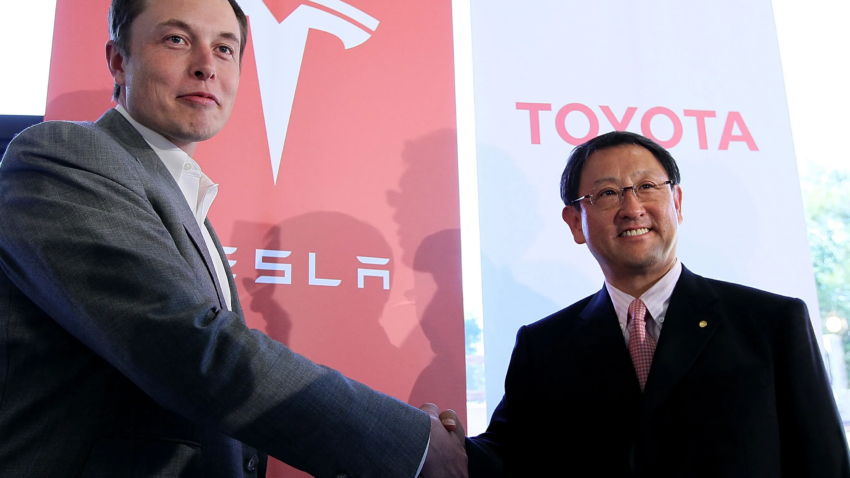

At a press appearance with then-Toyota President Akio Toyoda in November 2010, Tesla CEO Elon Musk said he was eager to learn about Toyota’s production process, calling it the “best in the world.” In accordance with the agreement, Tesla received $50 million from Toyota for an approximately 3% ownership in the business and paid $42 million for a portion of a recently closed auto factory in California owned by the Toyota-General Motors joint venture NUMMI.

Tesla had struggled to mass-produce the Model S, the first car created entirely in-house, due to a lack of manufacturing skills. The company’s cash on hand dwindled to roughly $100 million as it continued to operate in the red. The NUMMI plant arrived fully equipped, requiring little extra investment from Tesla. Some factory workers were retained as well. Looking back on the transaction, a Tesla official described it as a “stroke of luck,” given that the business lacked production know-how prior to acquiring the factory.

Related: Tesla Model Y Overtakes Toyota Corolla to Become World’s Best Selling Car in Q1, 2023

The partnership provided sparse returns for Toyota aside from finding a buyer for the California factory. Sales of a jointly develop EV were weak, and Toyota had sold off its entire Tesla stake by the end of 2016. Toyoda had led the charge in forging the partnership with the intent of “stimulating the slow-moving development department,” according to a Toyota official. But Toyota engineers, feeling that they could make EVs at any time, were less than enthusiastic toward cooperating with Tesla.

Tesla’s success has been built on identifying weaknesses in the auto industry and cutting against conventional wisdom. “With the entry of Tesla and Chinese companies, the rivals and rules in the industry are changing,” Akio Toyoda said at Toyota’s shareholders’ meeting in June 2017. Tesla sells its cars directly online without a network of dealerships. Although dealerships can provide potential car buyers with more personal service, this results in higher prices and greater costs for the manufacturer.

Related: Toyota Will Be Ready for 100% EVs from 2035

Tesla also took a different approach to Toyota’s kaizen philosophy of continuous improvements, such as the pursuit of cost savings no matter how small. When Tesla builds a new auto factory, it reassesses production methods from the ground up each time. The company continuously seeks a 50% reduction in costs, applying pressure internally and on competitors.

But Tesla also faces challenges, such as the pitfalls of growing into a large corporation. Employing 120,000 workers, it has the capacity to turn out 2 million vehicles a year. Making precedent-breaking management decisions that were possible as a startup will become more difficult. The novelty and relevance of the Tesla brand may also be fading. The price of Tesla’s used Model 3 in the U.S. fell by 20% in half a year as of this spring, underscoring a shift in consumer sentiment.

Related: Chinese EV Makers Heavily Investing in Thailand

With the development of Chinese automakers and newcomers from other industries, the auto industry is undergoing a dramatic upheaval. Tesla learned from Toyota during its rise, and now other automakers are learning from Tesla. The startup that pursued the field is now being pursued as the leader, confronting the obstacles and pressure that come with being the front-runner.

Source: Nikkei

A computer animation professional with over 23 years of industry experience having served in leading organizations, TV channels & production facilities in Pakistan. An avid car enthusiast and petrolhead with an affection to deliver quality content to help shape opinions. Formerly written for PakWheels as well as major publications including Dawn. Founder of CarSpiritPK.com