Auto sector in Pakistan is in hot waters since the last couple of years however the Fiscal Year 2019-20 turned out to be worse than expected. Sales of locally assembled passenger cars witnessed a 53% decline during FY2019-20 due to slowdown in economic activities, higher interest rates, constantly rising car prices & towards the end, due to coronavirus pandemic which virtually put car sales at a halt.

Related: Sales Tax Holidays in Malaysia- Can Pakistan Follow Footsteps?

However the automaker which seems to have suffered the most in these times is Honda Atlas, the sales of which reduced by 63% during last fiscal year. Honda sells three locally assembled products here– the Civic, City and BR-V, cumulative sales of which stood at 44,234 units in FY2018-19, however in FY2019-20 the sales got reduced to 16,387 units rendering a deplorable 63% decline. Not only that the sales got drastically reduced, the company posted an alarming Rs 511 million quarterly loss for the period ending June 2020.

Since long the company has stopped disclosing individual sales of two of its models– Civic & City although both are completely different vehicles from each other. Still the combined sales for the duo saw 39,189 units in FY2018-19 which shrunk to 14,091 units in FY2019-20 witnessing a 64% decline. On the other hand, BR-V the 7-seat MPV sold 5,045 units in FY2018-19 however its sales reduced by 54.4% in FY2019-20 to 2,296 units.

Related: Should Local Assembled Cars be Priced in Dollars?

So why Honda is feeling much of the heat compared to the others, well there are multiple reasons behind the ongoing demise & we are obviously not going to blame the depreciating currency or increased duties as the sole reason which the automaker often blabber about since the root cause is something very different which has been accumulating for many years & has remained unattended by the company.

Civic & City Stats Combined, Why?

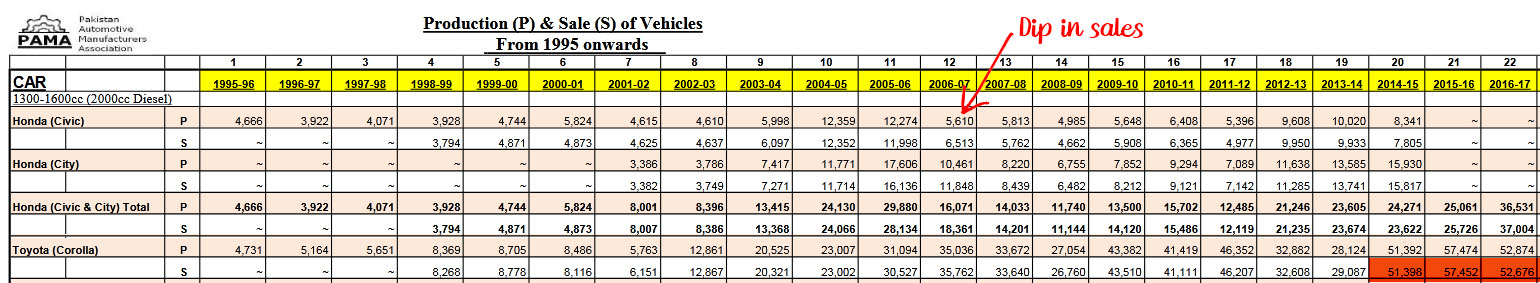

Honda stopped disclosing individual sales of Civic & City sedans from 2015. A year earlier in FY2013-14, it had sold 9,933 units of Civic and 13,741 units of City making a combined total of 23,674 units. In comparison Toyota Corolla sales stood at 29,087 which were 23% more than that of Honda Civic & City combined. However the following year in FY2014-15, sales of Civic were declined to 7,805 units whereas City got improved to 15,817 units, still the combined figure fell slightly short of the sales from preceding year with 23,622 units, but in contrast Toyota Corolla sales reached 51,398 units thanks to the introduction of 11th generation model & the difference between the sales increased from 23% in FY2013-14 to a massive 118% and that’s when Honda stopped disclosing the individual sales of Civic & City sedans. This difference remained so for many years until the 10th gen Civic was introduced in 2016-17.

Civic’s Departure from 1.6L Segment was Costly

If you observe PAMA data, the sales of Honda Civic started to suffer ever since it abandoned the 1.5 & 1.6L segments. Since 1996 ever since the 6th gen Civic arrived, the sedan was always available with a choice of 2 engines– a 1.5L version labeled as EXi and the 1.6L called VTi. Honda Civic recorded its highest-ever individual sales of 16,136 units in FY2005-06 when the 7th gen model was on sale. However the following year with the introduction of 8th generation Civic which was not only considerably expensive than the 7th model, was available with 1.8L engine only and the sales started to suffer.

And with that, Civic sales were literally reduced to half. Honda Civic had a strong foothold in 1.5 & 1.6L segments and leaving that playfield completely empty for Toyota Corolla to enjoy was an utterly foolish move by Honda Atlas. The 8th gen Civic was available with a 1.6L R16 engine option everywhere else and in Pakistan it could also have been offered with a choice of 2 engines as always. Even Corolla Altis has been offered with 1.6 & 1.8 liter options so why not Honda Civic?

The Price Factor

The 8th gen Civic was introduced in Pakistan on 29th July 2006, so year 2006 saw both 7th gen and 8th gen models being sold in the country. Below is the price list of Honda Civic from year 2006 which will give you an idea of the price difference, as the base model 8th gen Civic was considerably pricier than the flagship 7th gen Civic Oriel Prosmatec. This made the Civic lose a lot of its buyers and became restricted to only those with strong purchase power.

| 7th gen Civic 1.5L EXI M/T | Rs 10,02,000 |

| 7th gen Civic 1.5L EXI A/T | Rs 10,42,000 |

| 7th gen Civic 1.6L VTI M/T | Rs 11,47,000 |

| 7th gen Civic 1.6L VTI Oriel M/T | Rs 11,97,000 |

| 7th gen Civic 1.6L VTI P/T | Rs 12,37,000 |

| 7th gen Civic 1.6L VTI Oriel P/T | Rs 12,87,000 |

| 8th gen Civic 1.8L i-VTEC M/T | Rs 1,329,000 |

| 8th gen Civic 1.8L i-VTEC P/T | Rs 1,369,000 |

| 8th gen Civic 1.8L VTi Oriel M/T | Rs 1,459,000 |

| 8th gen Civic 1.8L VTI VTi Oriel P/T | Rs 1,499,000 |

Two Engines for Both Civic & City Meant Even Better Results

The Honda City is currently available with 1.3 & 1.5 liter engines, and that easily warrants the Civic to be available with 1.6 & 1.8 liter engine options. The Corolla was successful because it was available with three engines in Pakistan; even the Altis version is available with 1.6 & 1.8 liter engines. Having multiple engine options would have resulted in a greater market share which Honda Atlas never seemed to have considered.

Related: Honda Civic RS in Pakistan vs Elsewhere

Now with the 10th gen model, Honda has again started to offer 2 different engines- a 1.8 liter naturally aspirated, and a 1.5 liter Turbo, however with Civic becoming too much a pricier car, it no longer has many buyers as it used to have before. Those 10 years (2006 to 2016) & 2 generations of Civic (8th and 9th gen) with 1.8 liter engine only, already caused much of a damage to Civic sales & more importantly its market share in Pakistan.

Let’s Drag the City

Having made a bad move by abandoning the 1.6 liter Civic segment, Honda’s another bad move was to stretch the 5th gen City. In the absence of competition as Suzuki Liana got out of the race by 2010, Honda started dragging the 5th gen City which in 2020 has entered its 12th year of production in Pakistan. Today the local assembled City is two generations behind the global Honda City model and remains one of the most under equipped vehicles without a single airbag offered in its entire lineup.

City Sales Never Impressive After FY2005-06

Although the Honda City is considered a matter of bread & butter for Honda Atlas since Civic sales were already hit badly ever since the introduction of 8th gen model, however if we observe the sales of Honda City of late, have never been impressive either.

The highest sales Honda achieved with the City was in FY2005-06 when 4th gen IDSI model was being sold. The company saw 16,136 units being sold that year, however in the following years it was never able to come even close to this figure. After 9 years, it somewhat got a little closer with 15,817 units in FY2014-15 but after that Honda stopped disclosing the individual figures as its market share was badly disrupted after the introduction of 11th gen Toyota Corolla.

No Small Displacement Engine in the Lineup

Not having a small displacement engine in its lineup has costed Honda Atlas more than any other auto assembler in Pakistan. In early 2019, the company also encountered a sneaky situation following government’s decision to allow non-filers to purchase vehicles up to 1300cc engine capacity. Honda Atlas only has vehicles above 1300cc, as it assembles 1,339cc and 1,497cc City variants, 1,498cc BR-V and 1,799cc Civic models. The company then requested the government to allow non-filers to purchase 1,350cc vehicles instead of the 1,300cc in the following mini-budget. However a couple of months later, the ban on non-filers was lifted.

No Small Car Either

In recent years due to depreciation of currency value and added taxes, prices of cars became overly expensive. However Suzuki which is the only assembler of small cars in Pakistan felt the least damage due to the presence of small cars in its lineup.

Since Honda only assemble sedans & an MPV here which are now priced between PKR 2.3 million to PKR 4.5 million, their sales are taking a toll since prices of these cars have gone out of the reach of many. While people have turned their focus towards smaller fuel efficient cars (like Alto) which, despite being overpriced is currently the cheapest available option and is selling like hot cakes.

Related: Honda Brio- Small & Efficient But Not for Pakistan

Also, the Pak Suzuki Alto is the first 660cc kei car to be assembled in Pakistan. Honda has a number of such smaller cars offered in regional markets as well as kei cars in Japanese domestic market which they should have introduced here easily but their lack of interest to tap the small car segment is badly costing them at this stage.

Too Many Facelifts Won’t Save the Face

Ever since Honda Atlas stepped in, it was known as the pioneers in introducing modern technology, newer vehicles, as well as timely updating their product lineup keeping itself parallel to the global models. The company began operations in Pakistan in 1994 rolling off the 5th gen Civic but that car was replaced after hardly 22 months of production with the 6th gen Civic so as to keep the car aligned with the rest of the world, and this was the case with every Honda model up until 2009.

Related: Honda and Facelifts- Then & Now

Now the company has long lost its heritage and has been dragging the 5th gen City with worthless updates. You can come across memes on social media making fun of the daft grilles & shark fin antennas that try to redefine the 12 years old car as new.

Constantly Increasing Prices

Having observed more than 100 non production days during the first 6 months of fiscal year 2019-20 alone, Honda Atlas despite a sluggish demand in the market, kept substantially increasing the prices of its products perhaps to dampen the declining profit margins. In addition to the revisions due to added FED, prices of Honda cars were inflated from Rs 80,000 to up to Rs 300,000 within a year, whereas during the last couple of years alone prices were revised by up to 52% pushing the cars out of the reach of many.

Declining Quality Standards

Honda was once known as the best when it comes to the quality & fit n finish of the vehicles it assembled in Pakistan. However as the time progressed, the quality control has gone down the drain. Not only that the quality has declined, the absence of basics such as trunk linings & bonnet insulations etc are nothing but insatiable moves by the company to save costs.

Just some of the many images of the brand new Honda Civic with questionable quality control

Particularly with the launch of 10th gen Civic, plenty of images and videos surfaced the social media showing pitiful quality standards of local assembled Honda cars.

https://youtu.be/rkmSjbHwGGc

Stern Actions Needed for Survival

In order to survive, stern actions are needed to be taken by the company. They just can’t rely on selling a handful of overly expensive options or just keep looking at the sky hoping that something will magically come & improve their game here. What they should do is to:

- Reduce profit margins & bring the prices down to a realistic level

- Add multiple & lower displacement engines to the Civic lineup

- Introduce newer generation City to compete against the upcoming rivals

- Introduce hatchbacks such as new Brio to compete against Celerio/ Picanto

- Introduce 660cc kei cars to compete with Alto

And lastly, acquire Intellectual Property Rights of the 5th gen City and build one here as a local product. Got any suggestion? Use the comment section below to share your input.

A computer animation professional with over 23 years of industry experience having served in leading organizations, TV channels & production facilities in Pakistan. An avid car enthusiast and petrolhead with an affection to deliver quality content to help shape opinions. Formerly written for PakWheels as well as major publications including Dawn. Founder of CarSpiritPK.com