Car financing in Pakistan has been on a constant decline for 10 months in a row now according to data released by the State Bank of Pakistan (SBP).

Auto financing used to enjoy up to 60% share in the total vehicle sales which has now dwindled to just around 25%. According to analysts, one of the major reasons behind a sharp decline in car financing is the rising monthly payments due to the persistent increase in interest rates which currently stands at a whopping 22% as opposed to just 7% in March 2020.

Related: Can’t Even Avail Auto Financing, Who’s Buying All These Cars?

Another reason is the stringent financing criteria. Keep in mind that the State Bank modified the prudential rules for auto financing in 2021, as per which:

- The minimum required down payment has been increased from 15% to 30%.

- The maximum tenure of auto financing has been reduced from 7 years to 5 years.

- The maximum debt-burden ratio, allowed to a borrower, has been decreased from 50 to 40%.

- Auto financing limits availed by one person from all banks in aggregate, will not exceed Rs 30 lac at any point in time.

- Financing for imported vehicles has been completely prohibited regardless of engine capacity.

Many people think car financing is essential for purchasing new vehicles in these challenging economic times. Yes, it used to be that way, but with the price tags that “locally assembled” new cars now carry, you’ll be astounded by the projected monthly installments (EMI). According to the newest Numbeo data, the average income in Pakistan is Rs. 43,534 monthly. Keeping that in mind, let’s look at the financing costs and estimated monthly installments for ordinary mass-market vehicles in our market, which are supposedly aimed at middle-class buyers.

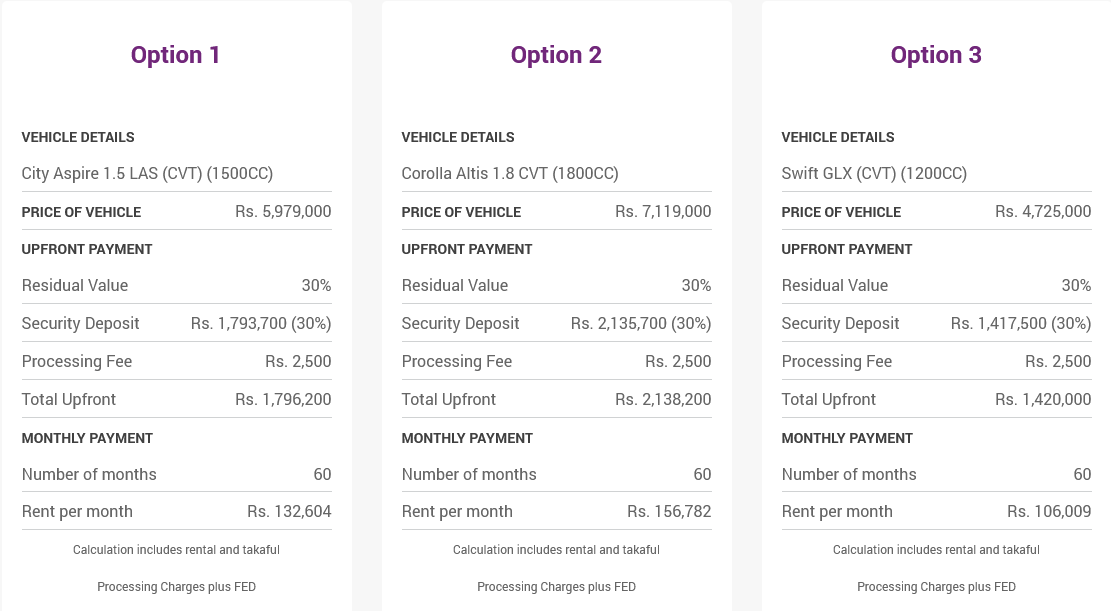

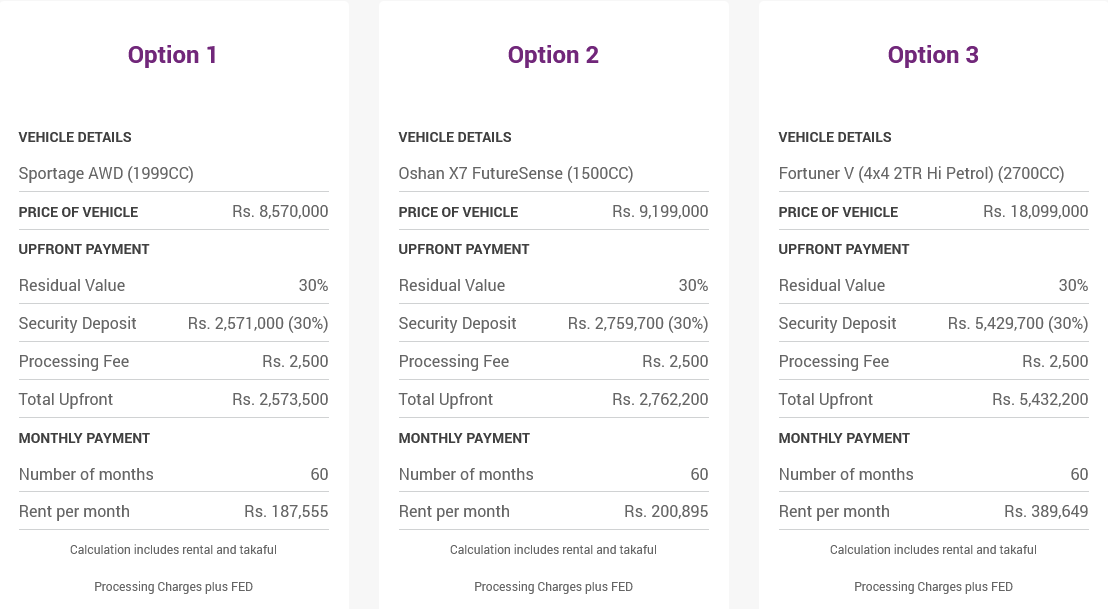

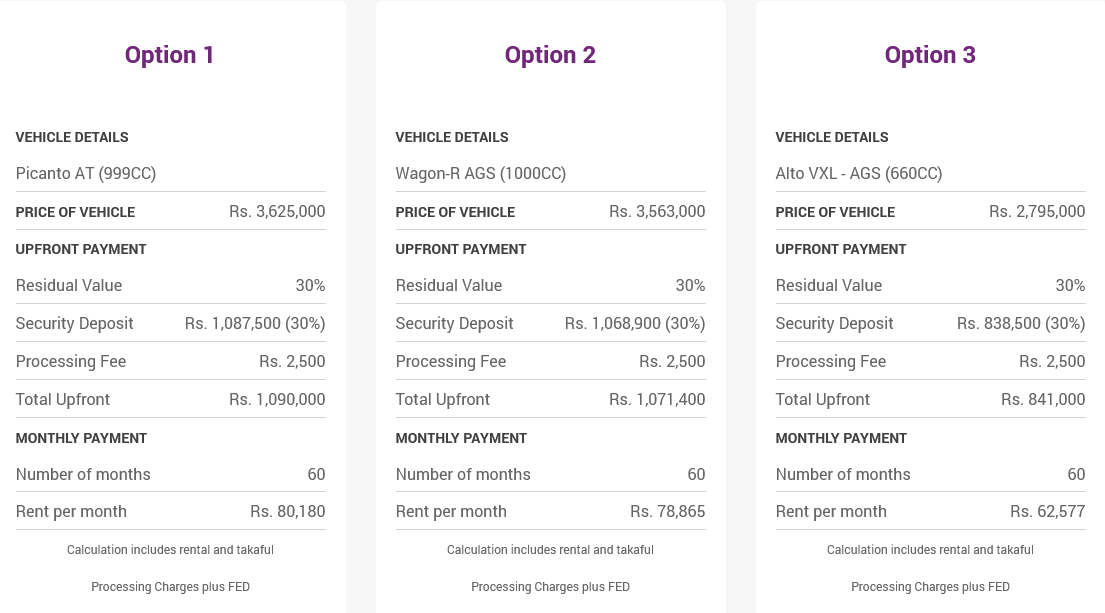

We have calculated the EMIs using Meezan Bank’s calculator, however, rates with other banks slightly vary but fall in the same bracket. Do note that the car prices mentioned on the Meezan Bank calculator aren’t updated, which means the actual EMI value considering the most latest prices will be even higher than the projected ones mentioned below.

Suzuki Alto 660cc is currently the most sought-after car in the market, despite dwindling sales it still is the highest-selling car in Pakistan. Now for a tenure of 5 years, which is the maximum one can avail using financing, and a 30% downpayment, the EMI for Alto AGS turns out to be a whopping 62,577 a month, not to mention Rs 841,000 payment upfront (including processing fee). And considering the PKR 29.75 lac price on the calculator, (which in reality is PKR 29.35 lac), the buyer will be returning up to PKR 45.91 lac to the bank including interest.

Related: Are New Automobiles Only for the Wealthy and Resilient?

The story of other cars isn’t different either, as someone buying a Suzuki Wagon R AGS in installments will need to pay back Rs 78,865 per month for straight 5 years, while those opting for a Kia Picanto AT will be returning Rs 80,180 per month. Too much for small hatchbacks, wait till you see the EMI of the Suzuki Swift which is a mind-boggling Rs 106,000+ a month.

The EMI for the Honda City Aspire CVT is even higher at Rs 132,000+ per month, while that of the base Toyota Corolla Altis is Rs 156,700+. If you step up for expensive crossovers & SUVs, get ready to pay Rs 187,500+ for the Kia Sportage AWD, while Changan Oshan X7 FutureSense will require you to pay Rs 200,800+ per month. Lastly, The Toyota Fortuner petrol will fetch Rs 389,600+ out of your pocket for 5 consecutive years if you decide to finance it against a 30% downpayment.

Remember that the car prices listed above have escalated by up to 8% from those utilized by Meezan Bank. Hence you can expect the actual EMIs to be around 8% higher than the projected ones shown above. One can easily correlate the EMIs of other vehicles in a similar price domain, the names of which are not mentioned above.

This is exactly why even private companies have stopped giving their employees brand-new cars, or those who are still offering, have downshifted from sedans to ordinary hatchbacks. For a salaried individual, it is almost impossible to get a car financed considering the fact that even a small Suzuki Swift can take away more than Rs 100,000 out of the pocket every month, what else is left for the guy keeping in mind the vehicle running & maintenance costs as well as his regular family expenditure which includes foods & groceries, health & welfare, education for kids & utility bill payments, etc.

Related: Should We Begin Importing Second-Hand Cars from India?

Without a long-term plan, it seems as though there is no end in sight to the endless political circus and the crumbling economy that no one is actually committed to fixing. New car sales have already been cut in half, auto financing has been on a decline for straight 10 months, people can’t buy ordinary cars, used cars are way out of the reach of buyers, fuel costs have already skyrocketed while most 4-wheel owners have already downgraded to 2-wheelers. Car financing allowed many people to fulfill their dream of owning a brand-new car. Unfortunately, that route is no longer accessible.

A computer animation professional with over 23 years of industry experience having served in leading organizations, TV channels & production facilities in Pakistan. An avid car enthusiast and petrolhead with an affection to deliver quality content to help shape opinions. Formerly written for PakWheels as well as major publications including Dawn. Founder of CarSpiritPK.com