WagonR was once among the best selling 1,000cc cars in Pak Suzuki’s lineup. However in recent times its sales have suffered quite badly.

Related: Are Tables Turning for Pak Suzuki?

| 2013-14 | 2014-15 | 2015-16 | 2016-17 | 2017-18 | 2018-19 |

| 1,621 | 5,246 | 9,709 | 17,671 | 29,206 | 32,614 |

The above table shows soaring sales figures of WagonR which improved every passing year. In fiscal year 2018-19 it recorded its highest-ever sales with 33,176 units sold. However the start of this fiscal year is dismal for Pak Suzuki’s tallboy hatchback.

Once known as the bestselling car (after Mehran) by Pak Suzuki, the WagonR is suffering from a horrific -72% decline in sales. As of the first 8 months of this fiscal year, the tallboy hatchback has only seen 5,812 units leaving the showrooms, whereas it sold 21,600 units in the corresponding period last year. The average monthly sales of Suzuki WagonR have fallen down to just 726 units a month, whereas in its glory days it sold at an average of 2,700+ units a month.

Related: Suzuki Alto, Cultus, WagonR & Swift Records Lowest-Ever Sales

However the following month was even more depressing as WagonR along with 3 other Pak Suzuki hatchbacks recorded its lowest-ever monthly sales ever since it was introduced in Pakistan. In March 2020 the WagonR saw only 310 units leaving the showroom floors.

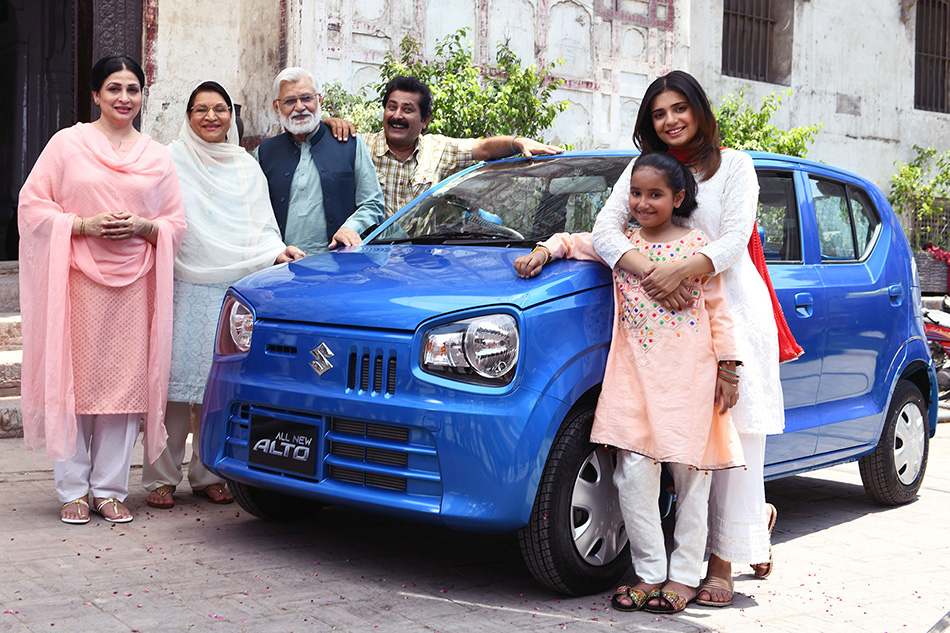

Introduction of Alto 660

So what has gone wrong with the WagonR all of a sudden? As analyzed by us earlier, the Alto 660cc has taken the major chunk of buyers away from WagonR. It’s primarily because the Pak Suzuki WagonR is a heavily underspec vehicle. The top-spec Alto VXL which is outrageously overpriced in its own league, offers way more than the top-spec WagonR VXL and it’s cheaper by Rs 250,000 when compared to the latter.

The Alto is more fuel efficient, offers more features and comes cheaper than the WagonR. And while both WagonR and Alto are certainly not among the better looking vehicles around, the Alto is still less awful to look at.

Decline in Ride-Hailing Demand & Car Financing

You might remember the WagonR took a long time to pick up sales when launched back in 2014. It took almost 4 years to match the per year sales of its predecessor– the 5th gen Alto. This was because of the influx of ride-hailing services such as Uber & Careem due to which demand of WagonR increased and most of these units were bought via car financing solely for commercial purpose.

Today the ride-hailing business is no longer as lucrative since thousands of people entered into the foray creating ample supply and lesser demand. Secondly introduction of bus-hailing services such as Swvl & Airlift as well as smaller bike-hailing Bykea, the business model of which was followed by Uber & Careem too, has dented the conventional car-hailing business. And with decline in car financing due to rising interest rates, the sales of WagonR were bound to receive a blow.

New Variant, No Difference!

In January 2020, Pak Suzuki introduced a new AGS (auto gear shift) variant with the WagonR but even then the sales remain subdued. In the first two months of this calendar year, the WagonR has sold just 1,266 units averaging 633 units a month which is even less than its dismal sales average of ongoing fiscal year. The company was also offering ‘Free Registration’ with Wagon R to lure the buyers. The Pak Suzuki WagonR variants currently retail at:

| VXR | PKR 1,605,000 |

| VXL | PKR 1,695,000 |

| VXL AGS | PKR 1,890,000 |

Coronavirus Lockdowns- Another Blow to Declining Sales

With the current COVID-19 pandemic, all automobile manufacturers are observing plant shutdowns to help prevent the spread of deadly virus. In this situation sales of locally assembled automobiles are expected to receive a major blow. The industry was already going through some tough times however upcoming period is going to be even tougher for the auto industry, as well as Pak Suzuki and the WagonR.

Cannibalization in Pak Suzuki’s Lineup

Back in the days of old, Suzuki offered 4 hatchbacks in our market each completely different than the other. Mahran catered as an 800cc small hatchback, the WagonR was a 1,000cc tallboy hatchback with fuel efficiency as a plus point, the MK-II Cultus which was loved for its easy maintenance and a rather bigger size which provided a sedan-like interior space and was preferred by companies for their executives, and the 1,300cc 2nd gen Swift.

Today 3 of Pak Suzuki hatchbacks offers similar size, similar engine (Celerio & WagonR have same engine) similar transmission and pretty much identical fuel efficiency figures, have created a cannibalization within Pak Suzuki’s product range and unfortunately WagonR with its awful looks, higher price tag and lesser features on offer is at the receiving end of the stick. Whether Pak Suzuki will continue offering the WagonR remains unknown.

Originally a Maruti WagonR

The WagonR we have here was originally the 2nd generation Maruti WagonR (which is different than the JDM WagonR generations). The Maruti WagonR was later made available in Indonesia badged as Karimun WagonR to suit the Indonesian government’s Low Cost Green Car (LCGC) policy. As importing from India was not possible due to political restrictions, the WagonR is imported as a knock-down kit from Indonesia and assembled by Pak Suzuki in Pakistan.

In January 2019, the WagonR entered its third generation in India, however it’s yet to be launched in Indonesia, which means as long as the updated WagonR stays in India, Pak Suzuki is in no position to shift to a newer model.

Related: Suzuki to Launch Premium Version of Wagon R in India

With sales as hopeless as they are now, whether Pak Suzuki will continue offering the WagonR is an interesting question. Else, it might match the fate of Liana sedan which kept selling at an average of 400 odd units during its last 7 years of its production.

What is your opinion regarding this, should Pak Suzuki discontinue the WagonR, bring down its prices, improve its safety & equipment or update to a new model altogether. Let us know with your comments.

A computer animation professional with over 23 years of industry experience having served in leading organizations, TV channels & production facilities in Pakistan. An avid car enthusiast and petrolhead with an affection to deliver quality content to help shape opinions. Formerly written for PakWheels as well as major publications including Dawn. Founder of CarSpiritPK.com