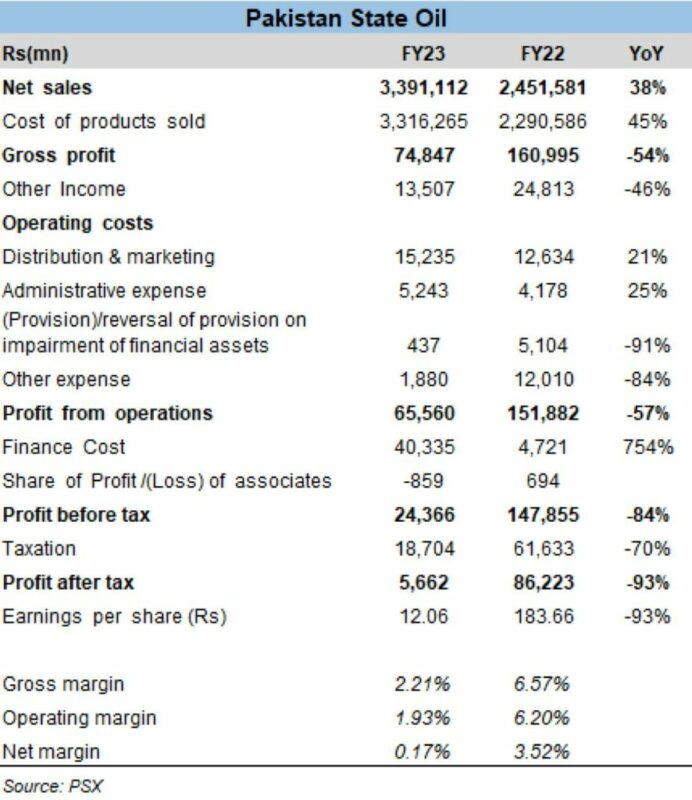

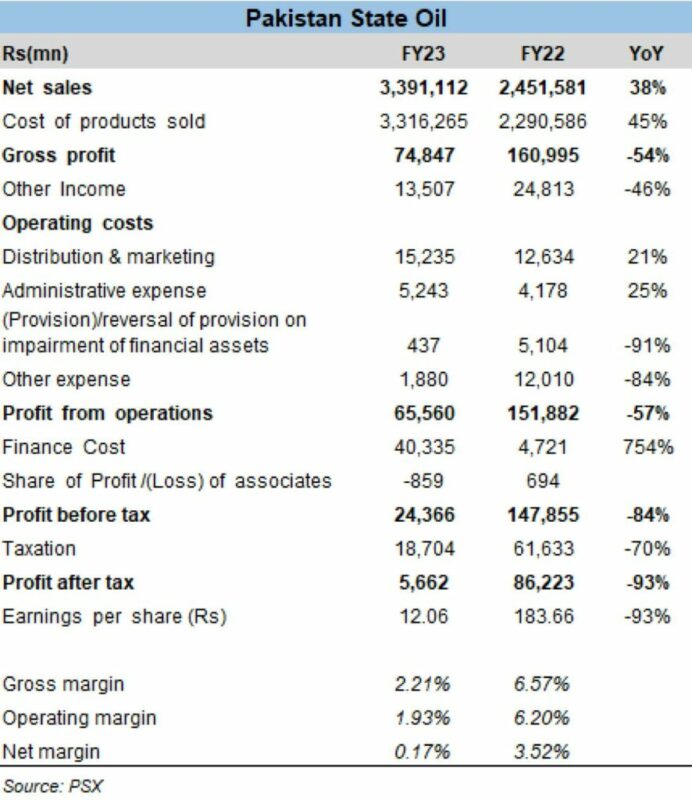

Pakistan State Oil (PSO) announced its financial performance for FY23. The company’s unconsolidated profit declined by 93% to Rs 12 billion from Rs 184 billion in FY22. Furthermore, PSO reported a 122% year-over-year decline in earnings for the most recent quarter (Q4-FY23).

PSO’s revenues in FY23 increased by 38% year over year but decreased by 3% in the fourth quarter of FY23. However, the volumetric sales of key petroleum products like motor spirit, diesel, and furnace oil decreased by 17%, 25%, and 64%, respectively, year over year in FY23. As a result, the increase in revenues in FY23 was solely attributable to higher selling prices of petroleum products.

PSO sales of motor spirit, diesel, and furnace oil decreased by 22%, 39%, and 97%, respectively, during the fourth quarter of FY23, accounting for roughly 48 percent of the overall volume decline. Although the oil marketing companies had experienced strong sales of petroleum products for the majority of FY22; due to the economic downturn, political unrest, and flash floods, FY23 saw the lowest petroleum product sales in the previous five years.

Due to inventory losses and weaker sales, PSO’s gross profit suffered in FY23 as well by 2.21%, a decrease of more than 400 basis points from the previous year. Additionally, the company’s operating margins decreased as a result of lower gross profits, despite noticeably lower reversals of provisions on financial assets and lower other expenses. Lastly, due to lower interest income on late payments, PSO also saw a decline in other income of about 46% year over year during FY23.

Source: Business Recorder

Responsible for delivering local & international automotive news.