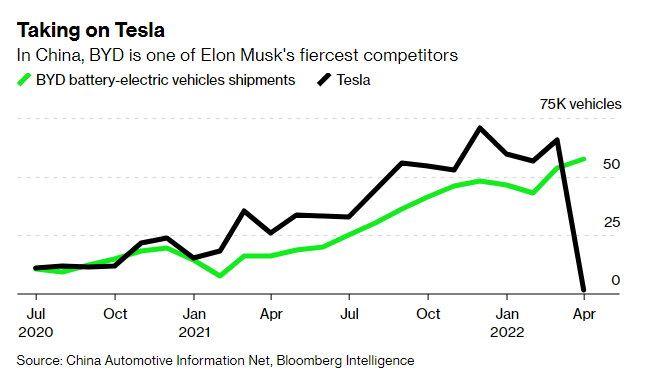

China’s BYD is once again the largest manufacturer & seller of electric vehicles (EVs) in the world’s biggest market, after rivals including Tesla were disrupted by Shanghai’s recent lockdown.

Related: EVs Accelerate China’s Looming Dominance as a Car Exporter

Now according to information, BYD is also working on plans to deliver a longer-term advantage over competitors, aiming to become more directly involved in the mining of lithium, the raw material that’s crucial for EV batteries.

In March, BYD agreed to invest up to 3 billion yuan ($449 million) in Chengxin Lithium Group Company, a supplier that has projects and interests in China’s Sichuan province and locations including Indonesia and Argentina. In January, the auto firm won a lithium extraction contract in Chile, the world’s No. 2 lithium producer. A recent media report also suggested that BYD is dramatically accelerating this strategy by striking a deal to buy 6 mines in Africa capable of producing enough lithium for more than 27 million EVs. That could be sufficient to cover BYD’s lithium demand for the next 10 years, according to The Paper, a Chinese digital newspaper.

Automakers are contemplating ever-closer involvement in their supply chains, including in the mining and refining of key battery metals, after a year of escalating costs that have pushed many manufacturers, including BYD, to raise sticker prices. One measure of lithium prices had an eye-popping rally of almost 500% in a year, and metals remain elevated now, even with some early signs the gains are cooling off. According to BloombergNEF, EV battery prices are expected to tick up this year for the first time in more than a decade, and broader inflation could delay the point at which electric models are as affordable as conventional cars.

Related: 5 Best-Selling EVs of the World in 2022

Though Elon Musk tweeted in April that Tesla “might actually have to get into the mining & refining directly at scale,” and said two years ago the company had acquired rights to a lithium clay deposit in Nevada, the company has mainly focused on sealing future supply agreements with existing producers. Liontown Resources Ltd., developing a project in Western Australia, confirmed it expected to begin shipping material to the carmaker from 2024.

There are potential pitfalls for auto producers considering a leap into commodities production themselves. The mining sector has a patchy record of delivering projects as planned, a wave of resource nationalism is complicating developments in some key nations and ESG investors are closely scrutinizing extractive industries over potential environmental damage.

Related: New Production Milestone for BYD Han

Securing sufficient supplies of raw materials is likely to be “the biggest challenge for all automakers for most of this decade,” Seth Goldstein, a Chicago-based equity strategist at Morningstar Research Services, said last week. According to Goldstein:

“The best solution would be for carmakers to lock in more long-term agreements with the industry’s major producers like Albemarle Corp. and Ganfeng Lithium Co., which have the most ability to bring on new supply. Investing in junior miners who have never produced lithium, or new technologies, is relatively more risky and could result in not being able to secure enough lithium.”

Source: Bloomberg

A computer animation professional with over 23 years of industry experience having served in leading organizations, TV channels & production facilities in Pakistan. An avid car enthusiast and petrolhead with an affection to deliver quality content to help shape opinions. Formerly written for PakWheels as well as major publications including Dawn. Founder of CarSpiritPK.com