Pakistan’s annual vehicle production, based on PAMA data, peaked at around 217,392 units in 2018 but has never gone beyond. That number since then has only seen a decline.

In 2019, with a 25% reduction in sales, the annual sales shrunk to 162,689 units. Then came the pandemic with just 104,387 units sold in 2020 rendering a further 38% decline in sales. In 2021, sales recovered to 198,921 units but were still 9% less than the figure from 2018. The numbers from 2022 and thus far in 2023 have been nothing but disappointing.

Related: PKR Recovers Against US Dollar- Will Car Prices Come Down?

The restrictions on CKD imports, massive delays in deliveries, declining currency value, steeply rising car prices, stringent auto financing, and reduced purchase power of the masses have all contributed towards a massive decline in new car sales which have reduced by 53% compared to the previous year.

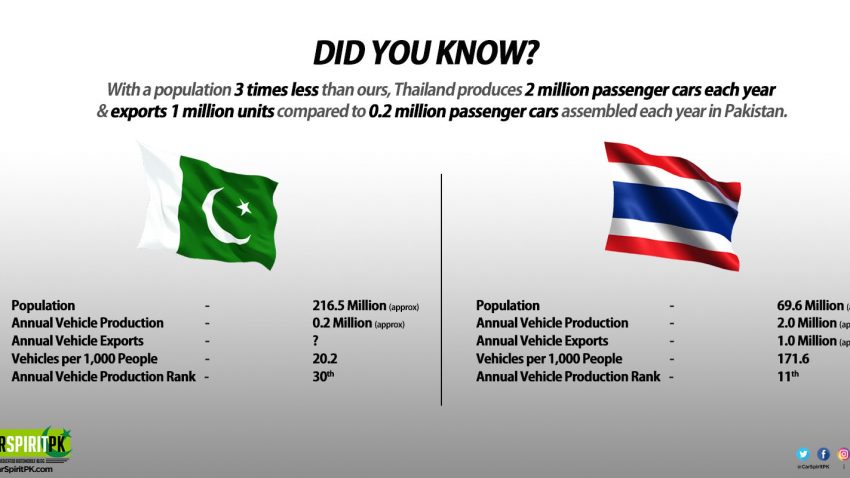

Despite having a population of almost 220 million and ranking as the sixth most populous nation in the world, Pakistan’s annual vehicle production of hardly around 0.2 million units makes it stand in 31st place in the world for the production of cars, with hardly any export. In order to provide a point of comparison, Thailand, which has a population of 69 million, or nearly three times that of Pakistan, produces 2 million vehicles annually, exports a respectable 1 million, and is the 11th-largest producer of vehicles worldwide.

Not so long ago, Pakistan was planning to enhance its annual automobile production to about 1 million units over the next 5 years. The government claimed that this was possible because a variety of automobile manufacturers, particularly Chinese companies, were interested in investing in the country’s auto industry.

However, the auto industry has not been able to scale as the domestic market is too small due to demand being squeezed through protectionist policies. Assemblers deliberately operate well below their production capacity to efficiently maintain a demand-supply gap that in turn favors them in many ways including earning premium/own money.

Related: Has Pakistan’s Auto Policy Benefited the Masses?

The protected domestic auto industry is always looking for incentives, will lobby the government to eliminate any kind of competition, even if it comes from decades-old used cars, and will continue to rely on imports just to assemble those imported parts locally. The players at one time claim to have achieved up to 70% localization only to remain 100% vulnerable to forex fluctuations. Interestingly, on the other hand, assemblers frequently argue that because there aren’t enough volumes for new models, the industry lacks sufficient localization.

But the assemblers themselves are never really interested in introducing cars that are volume sellers. In a market without any govt regulations, it’s much easier & less of a hassle for automakers to sell a handful of expensive products and provide their limited after-sales support rather than selling budget cars in volumes, which requires them to maintain a large number of spare part inventory and operate a bigger after-sales network.

Related: The Expensive Crossover Conundrum: A Closer Look at Automaker Priorities

Because larger & expensive cars ensure thicker profit margins, no automaker introduces volume sellers (small sedans or fuel-efficient hatchbacks) despite high demand in the market. Plus in an oligopolist market, there is no level playing field either, as the small car domain is left for Pak Suzuki while the larger car segment is enjoyed by Honda & Toyota. Newcomers too, are happy with introducing expensive crossovers & SUVs in the toughest of economic times and are least interested in achieving volumes, because of which the total industry output remains less than 250,000 units annually.

Furthermore, the auto policy fails to govern the minimum required standards (in terms of safety, fuel efficiency, or emissions) for any vehicle to be introduced in our country. This results in the majority of what has been introduced in Pakistan in recent years being globally obsolete models, so businesses are gifted with a golden opportunity to mint money from the tools & jigs that were discarded from the rest of the world.

Selling a handful of expensive crossovers definitely helps automakers achieve greater profit margins, but the auto industry as a whole remains stagnant & volumes never grow. In order to increase the output of our market, the government needs to incentivize smaller & fuel-efficient vehicles so that Pakistan may finally be able to breach its stagnant sales volumes, which are yet to even reach the 500,000 units per year mark.

Related: Economic Advisory Group Says Auto Policy is Damaging for Consumers

We need to completely rethink our policies, and decision-makers need to reset their thinking about what the auto industry has accomplished over the past three decades of protection. Will our auto industry continue to be reliant on imports, continue to spend billions of dollars on importing parts, and continue to whine about the negligible amount of used car imports?

To help boost the GDP of the nation, we require an industry that can export automobiles in good volume, if not fully assembled ones, at least automotive parts. If Pakistan can make fighter jets in collaboration with overseas partners and can sell them to other countries, why not cars? Are automobiles really that challenging to build in comparison to advanced fighter jets? We don’t think so.

A computer animation professional with over 23 years of industry experience having served in leading organizations, TV channels & production facilities in Pakistan. An avid car enthusiast and petrolhead with an affection to deliver quality content to help shape opinions. Formerly written for PakWheels as well as major publications including Dawn. Founder of CarSpiritPK.com