There was a time, particularly during the 1970s when the global automakers were shifting towards making small cars due to the international fuel crisis. Small hatchbacks like the iconic Mini, the first-gen Honda Civic hatchback, the Toyota Starlet, the Ford Fiesta, and the Fiat 127 were some of the popular cars developed during that era.

Related: China’s Emergence as a Global Car Player Threatens Hyundai and Kia

But today the global automotive industry is transitioning rapidly as a result of the switch from internal combustion to electric power. The majority of automotive-related aspects are evolving, including consumer behavior and driving styles, manufacturer development and concept, as well as customer interaction.

As with specific car segments, some countries and automakers are better equipped to handle this transition than others. While SUVs and premium vehicles can typically adapt easily to new powertrains, subcompact vehicles have greater issues. Because eventually, the price becomes the determining factor. Batteries continue to be a major production cost in electric vehicles and their price remains virtually unchanged whether it’s a modest city runabout or an expensive luxury car.

Related: For EVs in China, The Future is Now

For this reason, luxury and premium vehicles have become an increasing part of the EV portfolios of American and European automakers. Buyers who want inexpensive subcompacts and city cars aren’t willing or able to step up. Hence there is a significantly smaller selection of small EVs. Motor 1 has recently conducted this study which shows how small cars in the electrification age are rapidly becoming scarce, however, at the same time it is a golden opportunity for Chinese automakers to sweep up the game.

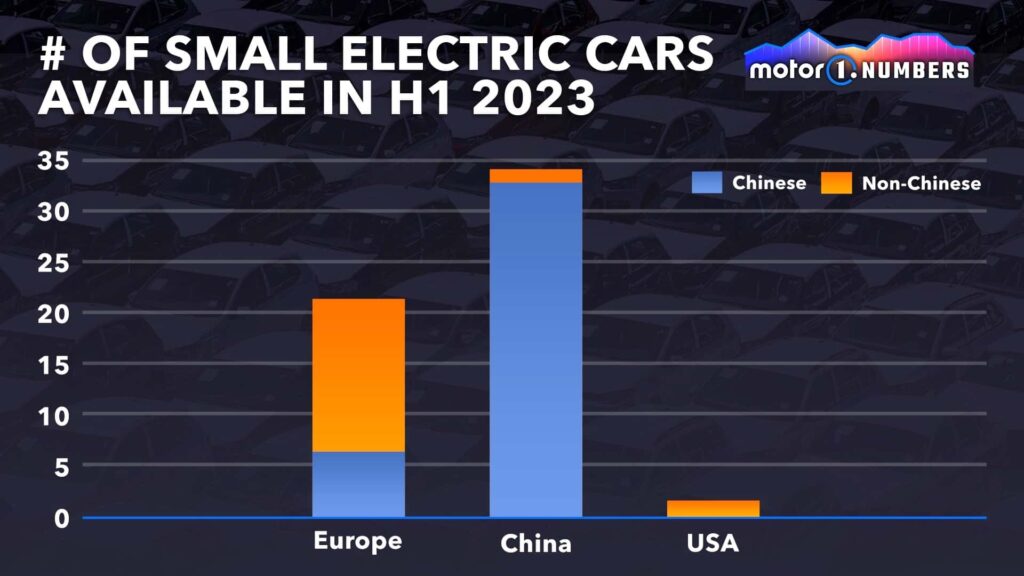

According to the said report, only 18 different small EVs for A and B segments were available in Europe as of the first half of 2023. In China, however, there were nearly double the choices with 34 different models. In the United States, there are just two: the Chevrolet Bolt EV and the Mini Electric. These figures stand in stark contrast to the abundance of small combustion engine vehicles that are on the market.

Related: China’s EV Push, Led by BYD, has Left Global Names in the Dust

As a result, the future of compact cars has two faces. On the one hand, there are those manufactured in Europe, which will continue depending on whether manufacturers can reduce battery costs. Because Europe is a region with high vehicle production costs, any increase in costs will continue to harm the financial viability of less profitable segments. Furthermore, government pressure in favor of electric vehicles is already pressuring automakers to discontinue making small cars or shift production outside of Europe.

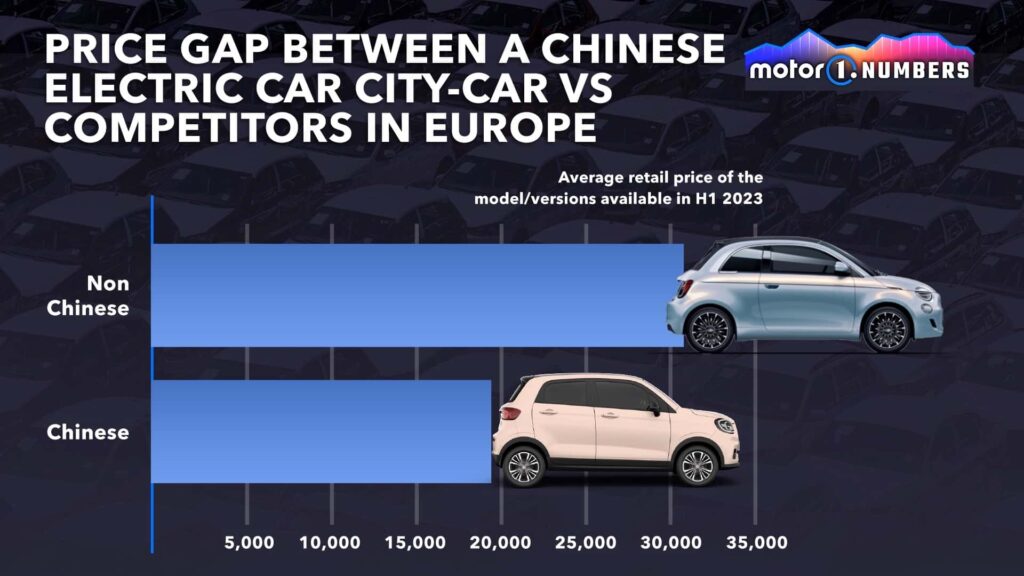

On the other hand, while this pressure grows on European manufacturers, it becomes the perfect opportunity for the Chinese industry to fill this gap. In fact, China’s workforce is more competitive and its strong commitment from the central government allows it to build electric automobiles at a much lower cost. Chinese subcompacts have the potential to disrupt international markets because they are typically 58% less expensive than non-Chinese subcompacts.

Therefore, unless manufacturing prices are lowered or policies are put in place to restrict the number of Chinese automobiles that are brought into the region, city cars and compact cars made in Europe will not survive.

Related: China Implements a Multi-Pronged Strategy to Drive NEV Boom

As evident from the above, India has the strongest demand for small cars and is able to fulfill it quite efficiently thanks to a robust domestic manufacturing system. However, in terms of exports, India is still behind China and other vehicle-exporting nations. Moreover, Indian homegrown brands have yet to make their presence felt in global markets, although they are doing pretty well in the domestic market.

This puts us in an intriguing situation. Since small automobiles are often less profitable than larger types, will US or European automakers be interested in producing them? Or are these companies going to completely give up on this market and let Chinese manufacturers build small cars? Or could there be a manufacturing melting pot? Some Western companies have already made investments in plants and are starting to manufacture cars in China for both the Chinese and international markets.

And consumers continue to purchase compact automobiles. In Europe in 2022, the small A and B car segments accounted for 23% of passenger car sales; in India, 51%; in Southeast Asia-Pacific, 28%; and in Africa, 38%. They continue to be a significant volume category as a result. Will the West give in to Chinese manufacturers even if their profits are lower than those of higher-profit segments?

Source: Motor 1

A computer animation professional with over 23 years of industry experience having served in leading organizations, TV channels & production facilities in Pakistan. An avid car enthusiast and petrolhead with an affection to deliver quality content to help shape opinions. Formerly written for PakWheels as well as major publications including Dawn. Founder of CarSpiritPK.com