The Federal Board of Revenue (FBR) has increased assessable customs value of MG vehicles by 14.5% from $11,632 per unit to $13,314 per unit by using ‘Fall Back Method’ as provided under section 25(9) of the Customs Act, 1969 according to a recent report published by Business Recorder.

Earlier, an audit of the importer JW SEZ Pvt Ltd was initiated regarding under-invoicing in import of MG HS vehicles imported by JW SEZ and supplied by SAIC Motor of China in the backdrop of alleged invoicing scam.

However, on the basis of audit process, initial findings in respect of unit price of imported MG HS/MG ZS/MG ZS EV were conveyed indicating minimum unit price to the tune of $22,000.

Interestingly, the Engineering Development Borad (EDB) has conveyed that CBUs imports in question were not imported under the ADP 2016-21 at concessional custom duty for test marketing purposes etc., meaning thereby that the imported vehicles under question are commercial in nature.

JW SEZ was awarded Greenfield status whereas reportedly, the investment agreement that includes approved business plan has yet to be signed. On signing of the Investment Agreement, the importing company will be entitled to import 100 vehicles of each variant in CBU at 50% of the prevailing duty/taxes for test marketing and concessional rate of custom duty at 10% on non-localized parts and 25% percent on localized parts for a period of 5 years. According to the Directorate of Post Clearance Audit:

“Prima facie, the importer is suppressing C&F value of imported vehicles in CBU condition attracting duties/taxes (@ 146% cumulative approx. at import stage by way of under-invoicing/under-valuation to enter into the market.”

The directorate added that consequently, the assessment of imported vehicles in CBU condition at current suppressed values will have a direct negative impact on collection of duties/taxes at the stage when they import the same vehicles in CKD condition at the concessional/reduced rate of duty/taxes @ 46% cumulative approx. on the basis of Greenfield status under the ADP 2016-21.

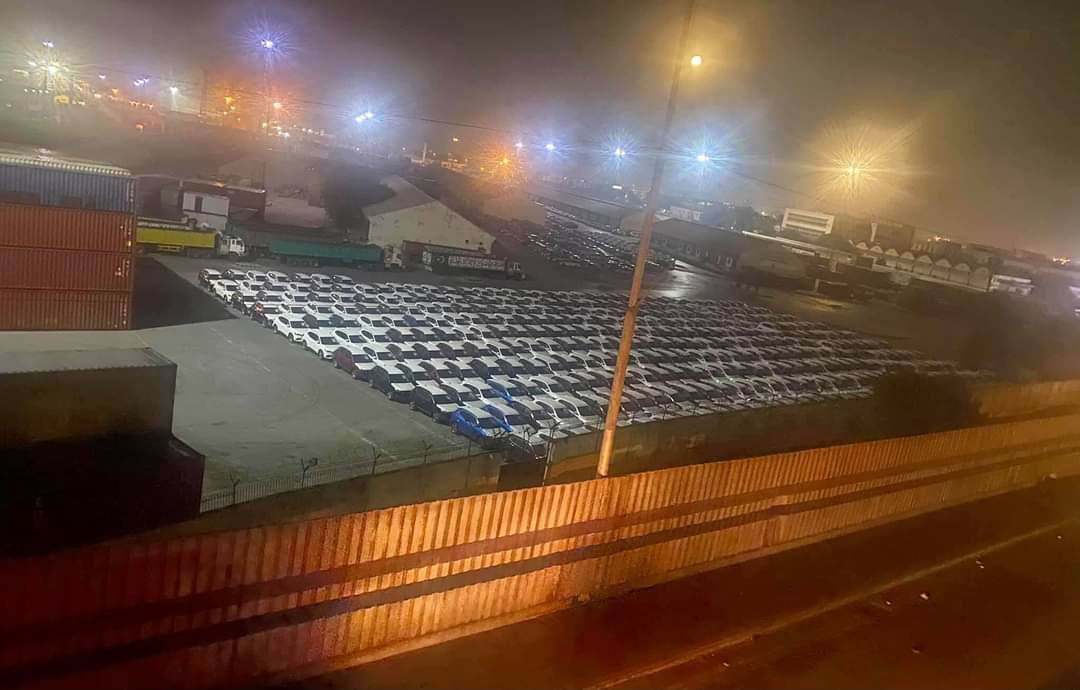

Related: MG Cars cleared at Karachi Port

The importer imported 747 vehicles vide 9 number of Goods Declarations filed between the period from November, 2020 to February, 2021. Earlier, Ms JW SEZ imported first consignment of MG vehicles (KAPW-HC-130493 on May 18, 2020) declaring motor vehicle model MG HS at unit price $ 14,000, model MG ZS at unit price $ 9,000 and MG ZS EV at unit price $22,000. However, subsequently JW SEZ imported 8 Goods Declaration, declaring motor vehicle model MG HS at unit price $ 11,632 and model MG ZS at unit price $ 9,245 and the same were assessed on declared values by the clearance Collectorates.

The Directorate of Post Clearance Audit states that the declared customs/transaction value by JW SEZ cannot be accepted as actual transaction value in terms of Section 25 (1) (d) of Customs Act, 1969, as the buyer (JW SEZ) and seller (SAIC International) are related parties, hence, their declared unit prices are found influenced, while the importer JW SEZ also failed to substantiate the declared values under the provisions of Section 25 of Customs Act, 1969.

According to the Directorate, JW-SEZ had to pay Rs 3.283 billion as total duties and taxes against 747 MG vehicles but it paid only Rs 2.024 billion which implies total duty and taxes recoverable are Rs 1.240 billion. The company will reportedly be paying difference of about $2000 from declared value of $11,632 and provisional value of $13,314 per unit under section 81 of the Customs Act.

Full story: Business Recorder

A computer animation professional with over 23 years of industry experience having served in leading organizations, TV channels & production facilities in Pakistan. An avid car enthusiast and petrolhead with an affection to deliver quality content to help shape opinions. Formerly written for PakWheels as well as major publications including Dawn. Founder of CarSpiritPK.com