In a significant shake-up, Nissan’s Chief Financial Officer (CFO) has reportedly resigned as the company grapples with a financial and operational crisis. The automaker is undertaking aggressive restructuring to address declining sales and profitability while navigating a highly competitive market environment.

Key Challenges and Measures

Nissan’s financial struggles have prompted the company to implement dramatic cost-cutting measures, including laying off 9,000 employees globally and reducing production capacity by 20%. The decision reflects an effort to streamline operations and counteract mounting losses. Additionally, the automaker is selling a significant portion of its stake in Mitsubishi, a move that underscores potential shifts in its strategic alliance with Renault and Mitsubishi.

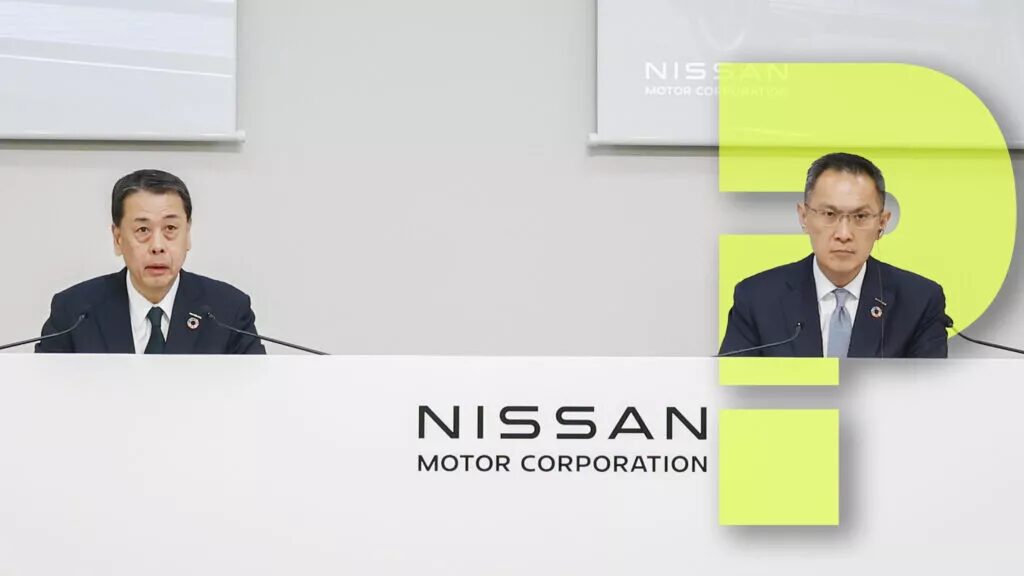

Makoto Uchida, Nissan’s CEO, characterized the situation as an “emergency mode,” emphasizing the urgency of stabilizing the company. To this end, Nissan is refocusing its business strategy, prioritizing hybrid vehicle production and expediting development timelines for new models. The U.S. market, where hybrid demand is surging, is a particular area of focus.

Reshaping the Alliance and Future Plans

The reduction in Mitsubishi’s stake hints at a reevaluation of Nissan’s partnership strategy. By realigning its investments and streamlining operations, the company hopes to rebuild profitability while preserving its market relevance. These measures follow a challenging period marked by leadership changes and a tumultuous global automotive landscape.

The Road Ahead

As Nissan implements these reforms, its success will depend on the effective execution of its revised strategies. The company’s renewed focus on cost-efficiency, electric vehicle innovation, and hybrid adoption reflects an effort to rebuild its reputation and financial stability in the face of adversity.

Responsible for delivering local & international automotive news.