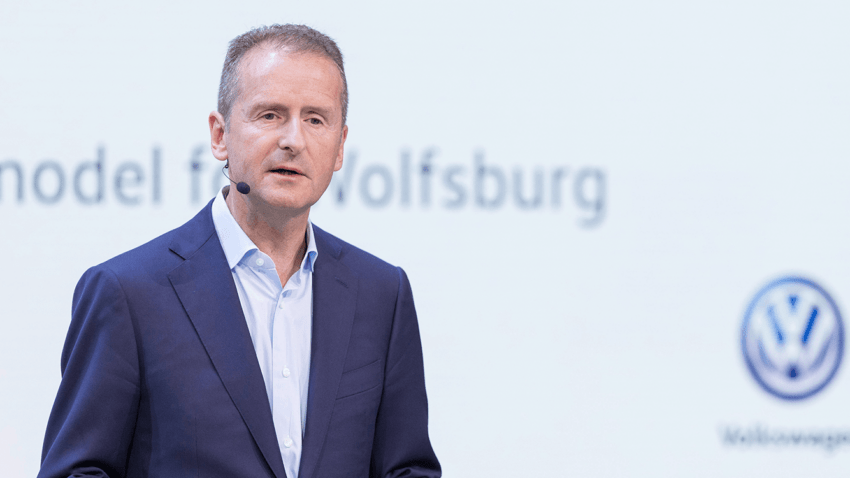

In a recent Volkswagen Group board meeting in Berlin, the CEO Herbert Diess has indicated that VW Group’s competitors now include Chinese brands including NIO, XPENG, BYD, and CATL. The high level meeting discussed the Group’s ‘NEW AUTO’ strategy which aims to turn VW and its subsidiaries into a global force across the fields of future car making such as mechatronics, software, batteries and charging, and mobility solutions.

Amongst the leading auto brands that Volkswagen sees on its radar, Chinese brands NIO, BYD, and XPENG loomed large, alongside EV market-leader Tesla, rising star Hyundai, and the global giant Stellantis. BYD also featured on the competitor list for ‘Battery & Charging’ alongside the world’s largest producer of automotive batteries, CATL of China.

Related: EVs in China are Cheaper by 47% Since 2011

Chinese electric vehicle (EV) brands are increasingly becoming popular in Europe and the astounding pace of growth is now worrying leading European automakers which are being left behind in the EV race. Not just in Europe, but China which is the world’s largest market for electric vehicles has turned out to be quite tough for European EV brands. For example, Volkswagen’s ID brand had a tough time in their first full year. Although they had confidently predicted sales of up to 100,000 units but fell well short, achieving just over 70,000.

VW Group also fell way short of BYD in terms of global EV sales during the first quarter of 2022. In comparison to 310,048 units of Tesla and 143,224 unit of BYD, the German giant managed to sell just 99,100 units in Q1, 2022.

Related: Bestselling EV Makers of the World- Q1, 2022

Critics point to Volkswagen’s comparatively low-tech offering, which can’t compare with the digital experiences of Tesla and China’s best homegrown brands. In the luxury car segment, cars from local Chinese brands such as Human Horizons and Hongqi are outpacing anything from Porsche and Audi in Chinese EV market.

Volkswagen’s response to the self-inflicted diesel scandal was to focus entirely on electrification. Yet, despite being one of the heaviest investors in EVs, the German brand still finds itself way behind both Tesla and BYD in China. Their 71,000 sales in 2021 stands pale in comparison to Tesla’s 310,000 and BYD’s 286,000 (including PHEVs) and, even if they hit this year’s target of 150,000 vehicles, they will still be way behind. Even Audi, one of the more proactive brands on the EV front, are lagging behind China’s NIO after the first quarter of 2022, with 24,200 sales in comparison against 25,800 of NIO.

Catching up the EV race is a “mountain” of a task and one that may take the best part of the next decade. Diess told the audience at the ‘Big Symposium’ in Berlin:

“We’re evolving from a classic OEM to a vertically integrated mobility company.”

This is because ‘NEW AUTO’ is not simply about making cars but about transforming into a sustainable, software-driven mobility service provider, a goal many of Europe’s big names share. Apart from the mammoth task of converting a giant organization that specializes in engineering ICE-powered vehicles into one that makes electric cars, VW also has to learn how to become a technology and software company, something brands like Tesla, NIO, and XPENG have been since day one.

Related: BMW CEO Warns Against All-EV Strategy

How successful these steps will be may take some time to ascertain. However, getting on par technology-wise with local brands in China and overcoming a new wave of enthusiasm will be an altogether different task.

Source: CarNewsChina

A computer animation professional with over 23 years of industry experience having served in leading organizations, TV channels & production facilities in Pakistan. An avid car enthusiast and petrolhead with an affection to deliver quality content to help shape opinions. Formerly written for PakWheels as well as major publications including Dawn. Founder of CarSpiritPK.com