Japan has all of the traits that would make it a leader in electric vehicles: above-average wages, a thriving auto industry, high rates of new-car purchases, and a culture that values technology. Instead, electric vehicles accounted for just 1.8% of new car sales in Japan last year.

Bloomberg has recently published a piece highlighting the countries that aren’t as far along the EV adoption curve as one might expect, and not surprisingly Japan tops the list of laggards.

Related: Japanese Automakers Face Major Sales Crisis in China

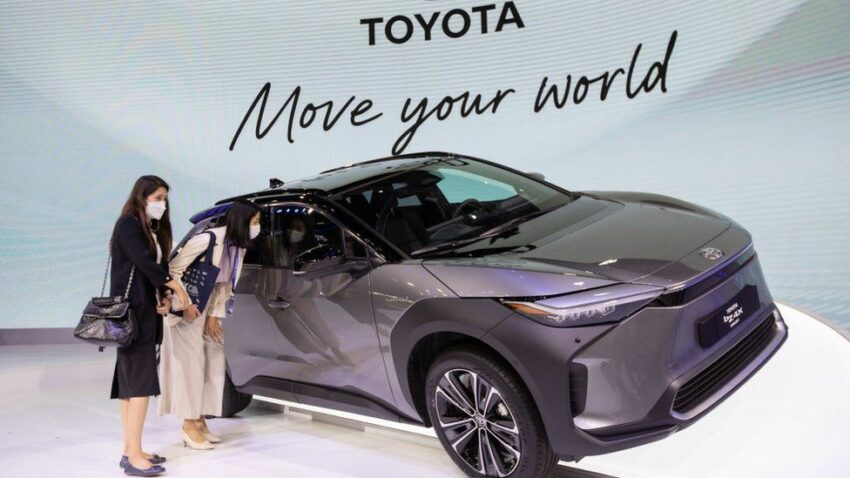

Japan’s slow adoption of EVs traces back to a bet made a decade ago by Tokyo technocrats and Japanese automakers to invest heavily in hydrogen fuel-cell technology. Toyota, the world’s largest carmaker, has since been a frequent EV skeptic, funding misleading advertisements, spreading anti-EV propaganda in schools, showing displeasure against the Japanese government’s push towards EVs, saying its hybrids will help reduce emissions more than electric vehicles, asserting that consumer choice dictates the pace of electrification, lobbying to get its hybrid tech the same benefits as EVs, and threatening to leave markets where EVs were favored instead of hybrids, and even claiming that time will tell Toyota’s EV point of view was the correct one, and lobbying against government policies that promote them around the world.

Japan’s dreams of leading a fuel-cell revolution haven’t materialized, and now it’s waking up to an automotive transformation that’s passing them by. According to BloombergNEF analyst Corey Cantor:

“They’re behind now, and that’s a big risk — right as BYD and other Chinese automakers gain prominence. It shows that in a major market, the impact that domestic automakers can have is massive.”

Japanese car buyers prefer tiny economical city cars known as kei cars — to the more expensive long-range family haulers favored by Americans. While Tesla accounts for half of EV sales in the US, the tiny Nissan Sakura occupies half of the EV market in Japan. The Sakura costs around ¥2 million ($13,300), after federal subsidies, and has a range of about 180 kilometers. It’s difficult for automakers to turn big profits on such small EVs, and sometimes the benefits to consumers of going electric — such as fuel savings, reduced noise, and improved performance — aren’t as obvious.

One of Japan’s biggest obstacles to catching up is its subpar infrastructure. The country has just 30,000 charging connectors, or about one per 4,000 EVs, according to data from Enechange Ltd., a Tokyo-based infrastructure provider. That’s less than a sixth of the density in the US or Europe, which has led to some of the worst charger anxiety in the world, according to data compiled by BloombergNEF. The Japanese government last year pledged to increase that number of chargers tenfold by 2030.

Related: Japan Finally Realizing its Fallen Behind in the EV Race

But Japan still seems to be a bit confused about pressing the pedal on EV adoption. It still bets big on hybrid tech, the technology that Japan premiered in the late 90s and has dominated it for decades only to find it overshadowed by EVs. Japan desperately wants hydrogen technology to be recognized as a viable option for EVs, but hydrogen filling stations are still non-existent, too expensive to build, and quickly disappearing in California, the only place where they were found in any significant numbers. Even Toyota’s biggest gamble on hydrogen, the Mirai, is battling to survive.

The fact that Toyota gave up its stake in the then-budding EV manufacturer Tesla in 2010, that Nissan essentially abandoned the Leaf EV—the world’s first mass-produced electric car—and that Honda recently discontinued its E mini electric hatchback just a few years after it was introduced—shows that Japan has nothing noteworthy to offer the world when it comes to EVs. Most of the EVs that Japanese automakers sell today are built using Chinese tech collaborating with EV makers in China, mostly to be sold in the Chinese domestic market.

Related: Toyota Struggles with Lack of Demand for bZ4X EV in Japan

Japanese automakers will have to work really hard to make themselves relevant in the EV race. Plus Japan will have to take serious steps to transition its auto industry from making conventional gasoline vehicles to making EVs. From sourcing minerals to making efficient batteries, from producing motors to making reliable and long-range electric vehicles, from making software to developing connected car technologies, the road is not going to be easy.

Source: Bloomberg

Responsible for delivering local & international automotive news.