Passenger car is a commodity that has customers in every society, however, in absence of sophisticated public transport, the desire to have a passenger car in Pakistan is probably higher than in many other countries. In fact, it has become a necessity to have a passenger car, be it new or old, in every home.

This great appetite to own a car has created an opportunity for the limited number of local assemblers to abuse the situation. For a long time, the Big-3 have exploited the situation by creating a monopolized market for themselves with products not rivaling in terms of price or segments. Then the companies operate much lower than the actual production capacity so the output volumes are always lower than the demand in the market. This then creates an opportunity for dealers & investors to exploit the customers by charging excessive amounts called premiums (own/ on money) & the undocumented profit is allegedly shared by the companies.

During the last few decades, various governments often make huge claims of taking measures to curb the menace of on-money culture, but practically nothing much has been done to eliminate this when the solution is perhaps easier than it looks. For example, In Japan owners of a new Toyota Land Cruiser J300 must sign an agreement to not resell the vehicle for at least 12 months after taking delivery but if they do, they won’t be allowed to buy another Toyota. How simple is that?

Related: A Market Where Cars Are Expensive Than Residential Property

Cars are generally considered a mode of transportation meant to take you from point A to point B in a rather dignified manner. Around the world, cars have a certain cost of purchase which depreciates over a period of time. As the car becomes old, it requires frequent maintenance as parts tend to lose their efficiency due to wear & tear.

Plus in developed markets, it’s mandatory to keep the car in utmost working order which is a hassle of its own due to which people prefer trading their vehicles in favor of new ones. Furthermore, as the technology moves on, newer cars offer features that are not available in the older models, and with government bodies keeping a strong check & balance on safety, emissions, fuel efficiency, and other key areas, customers always get a better deal buying a newer car replacing their slightly older ones. In most cases, new models are priced lower than the preceding model due to immense competition in developed markets.

However, in our market cars are treated as an asset, the value of which appreciates over a period of time instead of depreciating. Due to the absence of proper public transport, people prefer to have a car & opt for it as their daily commuter or buy more than one car dedicated to different people in the family.

Related: Anticipation of 1 Million Units & the Sudden Brake

Also due to protectionist government policies, we haven’t yet been able to develop a competitive automobile market as the industry is a hostage in the hands of a few companies who operate as a cartel by safeguarding each others’ interests & not introducing rival products in terms of price or segment. Furthermore, the prices of cars are revised ever so often due to various reasons including depreciation of currency as well as taxes & duties imposed by the government. Despite claiming to have achieved up to 70% localization, local assemblers have raised the price of their products in tandem with the value of the rising dollar against the rupee.

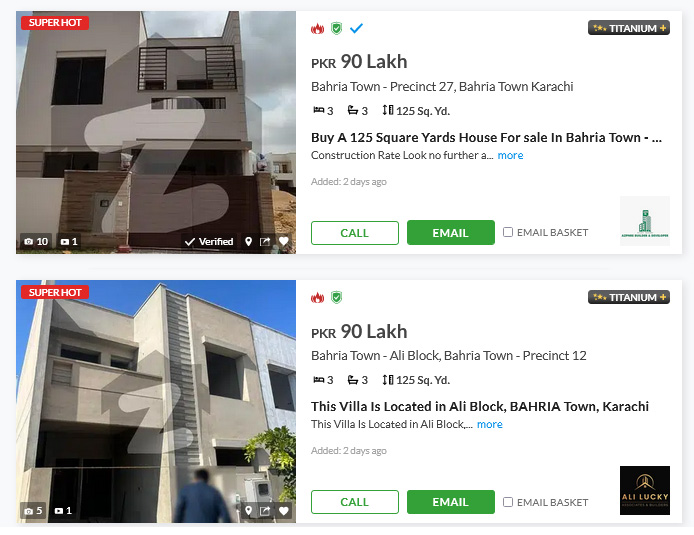

The increase in prices during the last few years has been so outrageous that most of the locally assembled cars sold in our country have already become more expensive than residential property. Today in Karachi, a small (new) apartment costs between PKR 6.5 million to PKR 8.5 million whereas medium-range new property costs between PKR 7 million to PKR 12 million. Of course, there is a vast variation in prices particularly when you consider the area, the accommodation, and various other factors however the idea is that the sort of money one spends in buying automobiles (which are considered consumables elsewhere) in our country can instead buy you a decent residential property.

A quick search on property portals shows us that a brand new (ground plus one) bungalow in Bahria Town which is a newly built posh locality on the outskirts of Karachi can be purchased for around Rs 9 million which is less than the price of a locally assembled 1.5L Honda Civic RS in Pakistan.

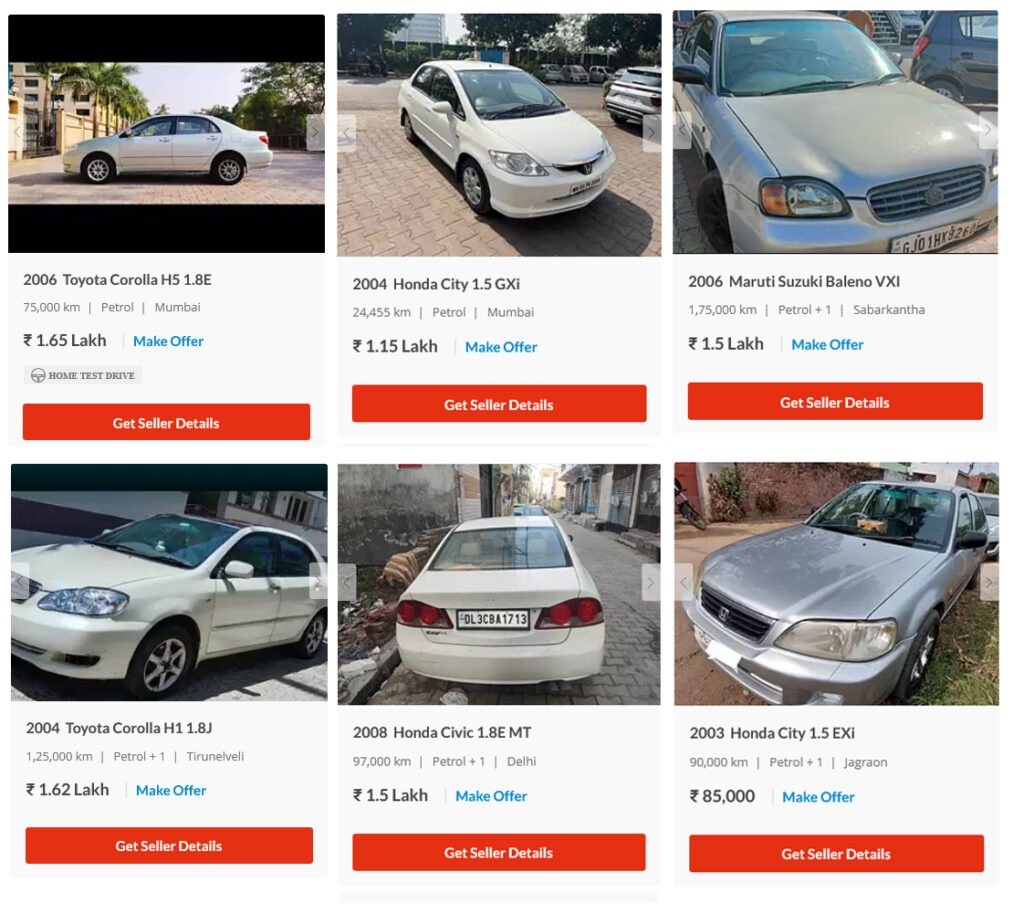

Related: 5 Years Old But Double the Price in Used Car Market

Listed below are cars that are available for over PKR 7 million in our market. And let’s not bring in the likes of German luxury cars into the debate which have always been expensive however the sort of cars that are mentioned below are in no way considered luxury vehicles in any part of the world and are in fact rather ordinary mass-produced vehicles.

| Make/ Model | Price | Origin |

| Honda HR-V VTi | PKR 7,199,000 | local assembled |

| Honda HR-V VTi-S | PKR 7,399,000 | local assembled |

| Honda Civic Standard | PKR 7,779,000 | local assembled |

| Honda Civic Oriel | PKR 8,099,000 | local assembled |

| Honda Civic RS | PKR 9,199,000 | local assembled |

| Honda CR-V 2.0 CVT | PKR 10,700,000 | CBU imported |

| Honda Accord 1.5L VTEC Turbo | PKR 15,499,000 | CBU imported |

| Toyota Hilux E | PKR 10,316,000 | local assembled |

| Toyota Hilux Revo G 2.8 | PKR 11,184,000 | local assembled |

| Toyota Hilux Revo G Automatic 2.8 | PKR 11,728,000 | local assembled |

| Toyota Hilux Revo V Automatic 2.8 | PKR 12,969,000 | local assembled |

| Toyota Hilux Revo Rocco | PKR 13,675,000 | local assembled |

| Toyota Rush G A/T | PKR 8,329,000 | CBU imported |

| Toyota Rush G M/T | PKR 8,009,000 | CBU imported |

| Toyota Prado TX 3.0D | PKR 27,930,000 | CBU imported |

| Toyota Prado VX 3.0 | PKR 39,270,000 | CBU imported |

| Toyota Prado VX 4.0 | PKR 41,410,000 | CBU imported |

| Toyota Corolla Altis Grande X CVT-i 1.8 Black Interior | PKR 7,039,000 | local assembled |

| Toyota Hiace Standard Roof | PKR 12,299,000 | CBU imported |

| Toyota Hiace High Roof Commuter | PKR 14,079,000 | CBU imported |

| Toyota Hiace High Roof Tourer | PKR 16,049,000 | CBU imported |

| Toyota Hiace Luxury Wagon High Grade | PKR 19,769,000 | CBU imported |

| Toyota Fortuner 2.7 G | PKR 14,230,000 | local assembled |

| Toyota Fortuner 2.8 Sigma 4 | PKR 17,175,000 | local assembled |

| Toyota Fortuner 2.7 V | PKR 16,297,000 | local assembled |

| Toyota Fortuner Legender | PKR 18,112,000 | local assembled |

| Toyota Corolla Cross Low Grade | PKR 12,249,000 | CBU imported |

| Toyota Corolla Cross Smart Mid Grade | PKR 13,099,000 | CBU imported |

| Toyota Corolla Cross Premium High Grade | PKR 13,419,000 | CBU imported |

| Toyota Prius S | PKR 14,649,000 | CBU imported |

| Toyota Coaster 29 Seater F/L | PKR 25,189,000 | CBU imported |

| Toyota Camry High Grade | PKR 47,559,000 | CBU imported |

| Toyota Land Cruiser ZX Gasoline 3.5L | PKR 138,319,000 | CBU imported |

| KIA Sportage FWD | PKR 7,350,000 | local assembled |

| KIA Sportage AWD | PKR 7,900,000 | local assembled |

| KIA Sorento 2.4 FWD | PKR 8,472,000 | local assembled |

| KIA Sorento 2.4 AWD | PKR 9,178,000 | local assembled |

| KIA Sorento 3.5 FWD | PKR 9,178,000 | local assembled |

| KIA Grand Carnival Executive | PKR 15,129,000 | CBU imported |

| Hyundai Tucson FWD A/T GLS Sport | PKR 7,464,000 | local assembled |

| Hyundai Tucson AWD A/T Ultimate | PKR 7,969,000 | local assembled |

| Hyundai Staria 3.5 A/T | PKR 8,364,000 | CBU imported |

| Hyundai Staria 2.2D M/T | PKR 8,499,000 | CBU imported |

| Hyundai Staria 2.2D A/T | PKR 8,909,000 | CBU imported |

| Hyundai Staria HGS | PKR 11,009,000 | CBU imported |

| Hyundai Sonata 2.0 | PKR 8,724,000 | local assembled |

| Hyundai Sonata 2.5 | PKR 9,484,000 | local assembled |

| Isuzu D-Max Hi Spark 4×2 Single Cab Standard | PKR 7,000,000 | local assembled |

| Isuzu D-Max Hi Lander 4×4 Single Cab Standard | PKR 8,200,000 | local assembled |

| Isuzu D-Max Hi Lander 4×4 Double Cab Standard | PKR 9,600,000 | local assembled |

| Isuzu D-Max V-Cross 3.0 | PKR 11,100,000 | local assembled |

| Isuzu D-Max V-Cross Automatic 3.0 | PKR 11,800,000 | local assembled |

| Changan Oshan X7 Comfort | PKR 7,999,000 | local assembled |

| Changan Oshan X7 FutureSense | PKR 8,599,000 | local assembled |

| Proton X70 Premium FWD | PKR 7,190,000 | local assembled |

| Haval H6 1.5T | PKR 8,525,000 | local assembled |

| Haval H6 2.0T AWD | PKR 9,749,000 | local assembled |

| Haval H6 HEV | PKR 11,095,000 | local assembled |

| MG HS Essence | PKR 8,199,000 | local assembled |

| BAIC BJ40 Plus | PKR 10,585,000 | local assembled |

| Chery Tiggo 8 Pro | PKR 9,299,000 | local assembled |

Above are only what’s considered mass-market offerings elsewhere. Luxury cars such as those by Audi, BMW, and Mercedes in Pakistan are much more expensive than these and hence are not included in the above list.

Related: Economic Advisory Group Says Auto Policy is Damaging for Consumers

The prices of these vehicles are way out of the reach of many and this is one of the core reasons why sales of new cars in Pakistan are constantly on the decline. These cars are available for much lesser prices in other parts of the world but the outrageous pricing of these “locally assembled cars” in our market either shows how incompetent the government authorities are, or how neglected the auto sector is, where consumers are at the mercy on the companies who can sell substandard, feature-ripped and often obsolete cars at a much higher price than a property asset.

A computer animation professional with over 23 years of industry experience having served in leading organizations, TV channels & production facilities in Pakistan. An avid car enthusiast and petrolhead with an affection to deliver quality content to help shape opinions. Formerly written for PakWheels as well as major publications including Dawn. Founder of CarSpiritPK.com