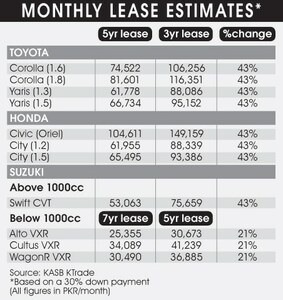

So this piece of analysis was published in Dawn and it reflects the sad state of affairs that most people can’t even afford to buy new cars even through bank financing. The estimated monthly installments were already mind boggling, as discussed in our earlier article however it looks as if even most of the white collar people are finding it hard to avail the financing.

Related: Car Financing Costs will Haunt You

According to the report, Mr Qamar Khan, who is a senior local entrepreneur, is one of the many people trying to move from Suzuki Swift to a Kia Sportage through a bank financing facility since February. After a meteoric price hike from Rs 4.75 million to Rs 5.4 million for the Kia Sportage during the last few months, followed by an increase in the interest rate, he finally decided to shelve his plans. Qamar Khan angrily says:

“I cannot buy at this huge price. The rest of the damage was done by a 1.5% rise in interest rate to 13.75% recently, followed by a reduction in tenure of financing from 5 to 3 years on above 1,000cc vehicles, making monthly installments unmanageable.”

Slashing the tenure to 3 years means a buyer has to manage an extra monthly amount amid the looming uncertainty of further hikes in interest rates, rising prices, and more curbs on auto financing to control the current account deficit, he added.

Ahmed Shamim, who is Regional Manager-South in the Consumer Auto Finance department of Dubai Islamic Bank Pakistan Limited, says consumer auto financing has shrunk to 20% after the State Bank’s revised prudential regulations. Less than 1,000cc locally-assembled vehicles could be financed with minimum 30% equity instead of 15% and tenure has also been revised to 5 years from 7 years. He claims that the debt burden ratio cap of 40% and a minimum down payment of 30% makes it impossible for an average middle-class person earning Rs 100,000 per month to obtain car financing.

Related: State Bank Reduces Auto Financing Loan Tenure

Above 1,000cc vehicles can be financed with a cap, but the tenure will be 3 years rather than five. Changes in tenure and the cap on aggregate debt burden ratio are impacting businesses directly, which is actually problematic for the middle class person who wants to get a car on financing, Mr Shamim said.

Related: Are Hybrid Cars a Mid-Term Solution Before Launching EVs in Pakistan?

A private banker dealing in auto financing, on the condition of anonymity said, “It seems that we are unlikely to achieve our target in June after a fresh hike in interest rates and a cut in months for installments.” He said the assemblers are a bit relaxed now due to the pile up of advance bookings in their hands whose delivery time ranges between 2 to 9 months.

The impact of high interest rates and shorter month-to-month duration will undoubtedly be felt in the coming months. He said that with already high food inflation and a further possible price hike in essential items after a massive increase in petroleum prices, it would further make the household budget of consumers more difficult to manage. This would make them more reluctant to take car financing, he added.

Related: Assemblers Anticipates up to 30% Decline in Car Sales

Mr Saqib Wasim said, “I have cancelled the plan to purchase a new Suzuki Ravi and Toyota double cabin for my “rental business” soon after a new hike in interest rate and rising monthly installment after a cut in the tenure of paying monthly installment.”

Another private banker said the auto financing has drastically plunged after a recent hike in the policy rate. Besides, the ban on used car imports has put another dent in auto financing. He said “The bank is charging 18% interest rate as compared to 14% which will be difficult for many consumers to afford.” The banker went on to add that “The trend has reversed. Today we are looking towards buyers while last year, buyers used to come in large numbers for the auto financing.”

Related: Ban on CBU Imports- Who Will Suffer?

Founder and CEO Carfirst, Raja Murad Khan said as the new locally-assembled cars are getting pricier multiple times in a year, the second hand vehicles’ market will continue to bear the brunt. Used cars also tend to get more and more expensive. A 3-year old locally assembled Honda Civic is now selling for Rs 4 million & above but a new one now costs over Rs 6 million.

The average price of a used vehicle is not less than Rs 1.9 million which used to be Rs 1.1 million three years back. The demand for used vehicles has soared substantially as a number of people are unable to afford to buy costly locally-assembled cars. As a result of high demand, the prices of used cars have also risen in tandem with locally-assembled cars, he said.

Related: Government Considering to Reduce Taxes to Alleviate Price Hikes

According to Raja Murad Khan, “Demand for used and even 660cc-1,000cc cars is likely to further escalate after Rs 30 per liter jump in petrol prices, while more price shocks are on the cards,” he said, anticipating a further price jump in used cars. Many people, while failing to afford new locally-assembled cars, are rapidly switching over to used cars, especially in the 660cc-1,000cc category.

He claimed that his company receives purchase inquiries from buyers in the price range of Rs 1.5 million for small cars to Rs 3.5 million for high-engine power used vehicles of 2014 to 2017 models. Three years back, this price tag was hovering at Rs 1m to Rs 2.5m.

Related: Another Price Increase Anticipated as PKR Nosedives to Record Low

When asked about the impact of high interest rates on the sale of new cars, he said, “I am sure that the impact of rising interest rates on car sales through bank financing will not be so intense as long as the old tradition of high demand and low supply from the assemblers continues to persist in the future as well.”

While the common man continues to suffer from rising car prices, the assemblers are able to post record sales thanks to a large number of investors/ hoarders in the market who intend to make profit out of each deal. According to a research by Pakistan Institute of Development Economics (PIDE), it has been revealed that the automobile sector of Pakistan has made undocumented transactions worth Rs 150 billion to Rs 170 billion during last 5 years under the head of additional charges, also known as own/ premium, paid to the car dealers to get an immediate delivery. As per this research, around 80 to 90% of passenger vehicles in Pakistan are sold against premium/ on money.

Source: Dawn

A computer animation professional with over 23 years of industry experience having served in leading organizations, TV channels & production facilities in Pakistan. An avid car enthusiast and petrolhead with an affection to deliver quality content to help shape opinions. Formerly written for PakWheels as well as major publications including Dawn. Founder of CarSpiritPK.com