When the auto industry struck its lowest in FY20 due to COVID-19, who would have thought that a similar situation will occur again without any impacts of pandemic lockdowns? But when we move forward to FY23, the numbers become even more terrible than they appeared three years ago.

Sales of locally assembled vehicles saw a deplorable 53% decline in FY2019-20 compared to sales from the preceding year as only 110,583 units were sold compared to 235,229 units sold in FY19. But in FY23, a total of just 96,812 units were sold, down 59% against 234,180 units sold during FY22. This is also the first time ever that the sales of PAMA members which include big names such as Toyota, Suzuki, Honda, Isuzu, Gandhara, and Hyundai stood below the 100,000 units mark in a fiscal year.

Related: Car Sales Decline by 82% in June; and 59% in FY23

The massive slowdown in sales is mainly attributed to import restrictions that have been put in place to preserve the outflow of precious foreign reserves. The local auto industry which remains heavily dependent on imports suffered badly as many key players had to constantly observe plant shutdowns & non-production days due to lack of CKD parts in hand. This was coupled with massive depreciation of currency value which saw car prices increasing in tandem with automakers announcing substantial revisions every second week.

Domestically assembled cars are no longer affordable to the majority of people, and their prices are absolute examples of lunacy. With a 660cc hatchback reaching Rs 3 million, ordinary 1000cc hatchbacks around 4.5 million, and common B-sedans up to 6 million while C-sedans are already beyond the 10 million range. And considering the quality, safety, and features offered, such price tags also make a complete mockery of any regulations that may be in place.

Related: Pak Suzuki Alto on a Roller Coaster

For example, across the border, a small Hyundai Exter that starts from INR 5.99 lac comes equipped with 6 airbags as standard across the range. Here, the Toyota Fortuner GR-S which happens to be the most expensive locally assembled vehicle at PKR 2 crore 10.89 lac has only 3 airbags on offer. This is just one plain example of how badly locally assembled vehicles fall short of equipment, and we haven’t yet highlighted the missing elements such as projector headlamps, passive safety equipment including pedestrian safety, etc because that concept is simply non-existent here.

Not to mention locally assembled vehicles are yet to comply with Euro-5 standards (most are still Euro-2) something they said in 2020 will require 2 years to upgrade to, but even after more than 3 years there is no sign of locally assembled Euro-5 vehicles across the board, though some models being offered are Euro-4 but that’s only case with the 30% new cars on sale, as the rest of the 70% are globally obsolete models.

Related: Obsoletometer- Check Which Automaker Sells Most Number of Obsolete Cars

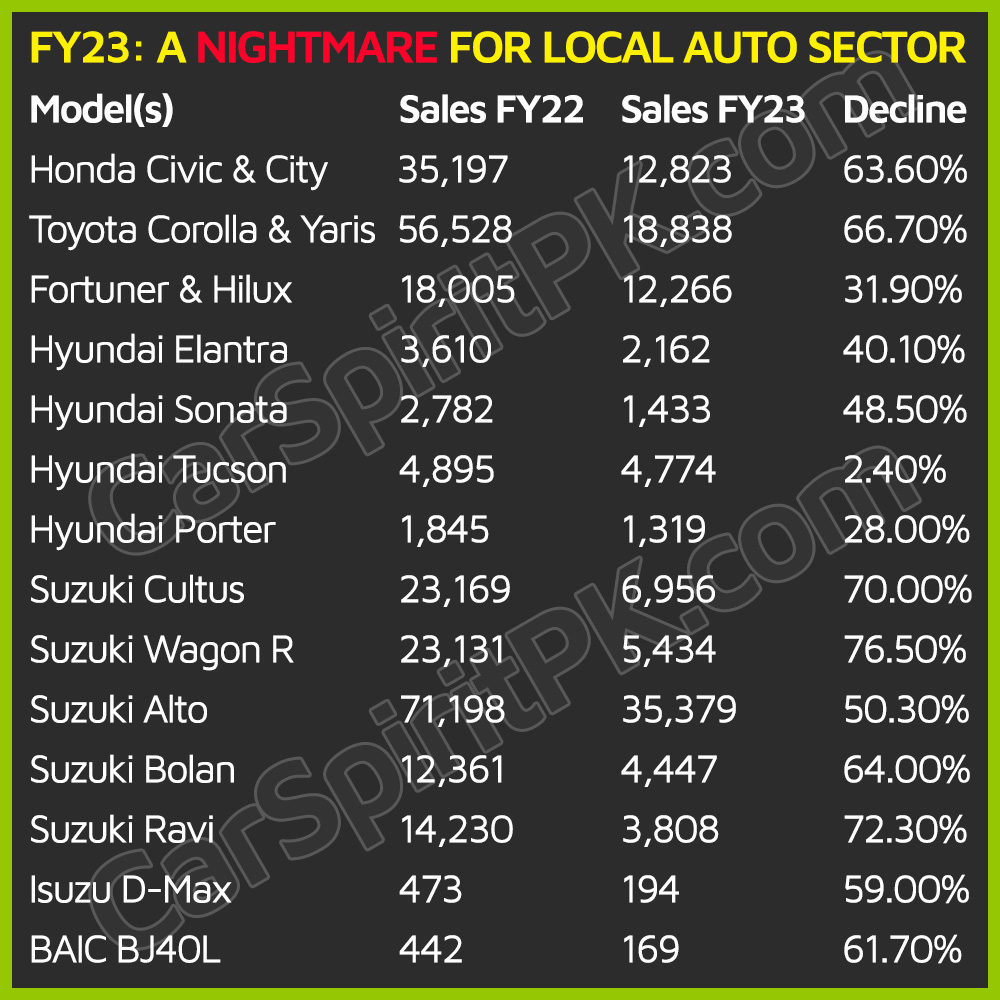

Let’s move on from the argument and return to the poor sales of domestically assembled vehicles in FY23 and compare them to figures from FY22. To put it mildly, the decrease is just horrifying.

Honda Civic & City

Honda Atlas which presents combined numbers of Civic & City sold 35,197 units of the two in FY22 but saw a 63.6% decline with just 12,823 units in FY23.

Toyota Corolla & Yaris

IMC also presents the combined number of Toyota Corolla & Yaris which stood at 56,528 units in FY22 but fell to just 18,838 units in FY23 witnessing a 66.7% decline.

Suzuki Swift

Swift was introduced in February 2022, so obviously just 3 months of sales data is there for FY22. Hence it’s not fair to compare its numbers from FY22 with FY23. Still in terms of sales average, Swift went down from 2,063 units a month in FY22 to just 778 units in FY23 which renders a 62.2% decline.

Honda BR-V & HR-V

Honda Atlas introduced the HR-V in Pakistan in October 2022 after which the company merged the BR-V sales with HR-V to present them as a unified number. Hence the 4,255 units in FY22 were of BR-V only but the 4,056 units in FY23 are a combination of HR-V & BR-V. Individual sales are undoubtedly pitiful, but even the combined number for FY23 is lesser than BR-V’s individual sales for FY22, making the situation utterly dismal.

Hyundai Sonata & Elantra

Thankfully, Hyundai still presents individual numbers of Sonata and Elantra. According to the data, Sonata sales in FY22 were 2,782 units which came down by 48.5% in FY23 to 1,433 units. Elantra on the other hand witnessed sales of 3,610 units in FY22 which was reduced by 40.1% to 2,162 units in FY23.

Suzuki Cultus & Wagon R

Pak Suzuki’s 1000cc duo of Cultus and Wagon R also saw a massive decline in sales. Cultus clocked 23,169 units in FY22 while only 6,956 units in FY23 which renders a deplorable 70% decline. Wagon R on the other hand witnessed sales of 23,131 units in FY22 which came down by an appalling 76.5% to just 5,434 units in FY23.

Suzuki Alto

Suzuki Alto has remained the bestselling locally assembled car in Pakistan ever since it was launched in June 2019. Last year in FY22 it recorded sales of 71,198 units which is the highest ever for any locally assembled in PAMA’s history. However, in FY23 sales came down by 50.3% to 35,379 units. Still in terms of sales, to a wide extent, Alto continued to be the most popular car in FY23.

Suzuki Bolan & Ravi

Old grandpas Bolan and Ravi also suffered from a huge decline in sales. Bolan went down by 64% from 12,361 units in FY22 to just 4,447 units in FY23. Ravi suffered from a dreadful 73.23% decline having witnessed sales of 14,230 units in FY22 versus just 3,808 units in FY23.

Toyota Fortuner & Hilux

The combined number of Fortuner & Hilux as presented by IMC shows 18,005 units in FY22 which declined by 31.9% in FY23 to 12,266. Surprisingly the decline in sales for such pricey vehicles is minimal when compared to less costly options.

Hyundai Porter

Sales of Hyundai Porter stood at 1,845 units in FY22 and clocked at 1,319 units in FY23 witnessing a 28% jolt in sales.

BAIC BJ40L

Sazgar’s BAIC BJ40 fell down from 442 units in FY22 to 169 units in FY23 registering a 61.7% decline.

Isuzu D-MAX

Isuzu D-Max went down from 473 units in FY22 to 194 units in FY23 witnessing a 59% decline in sales.

The Exception

There are a few outliers despite the deplorable fall in sales that the majority of locally assembled cars experienced. Let’s explore it in detail.

Hyundai Tucson

Hyundai Tucson was probably the best performer when you consider the least decline in sales it suffered. Tucson sales in FY22 were 4,895 units which was reduced by just 2.4% to 4,774 units which is impressive, to say the least.

Chery Tiggo

Gandhara began sharing its data in PAMA charts from FY23, so FY22 sales stats aren’t available. Still, in the recently concluded fiscal year, 1,268 units of Chery Tiggo SUVs were sold which include both Tiggo 4 Pro and Tiggo 8 Pro.

Haval

Sazgar also started sharing its data for Haval SUVs from September 2022 onwards, as per which 1,657 units of Haval SUVs were sold which include H6 gasoline as well as hybrid versions.

Other Players

Various industry sources claim that non-PAMA members like Changan, Kia, Peugeot, United, DFSK, and Proton also saw a decline in sales; however, accurate data is not yet available, making it impossible to gauge the severity of the blow.

Related: Are Auto Consumers of Pakistan Being Given a Fair Deal? Part 4

The poor condition of the local auto industry is quite concerning in light of the country’s ongoing economic difficulties as it struggles to replenish its foreign reserves while relying solely on acquiring IMF loans or cash deposits from friendly nations, both of which only provide short-term fixes that never last for an extended period of time. According to data issued by the Pakistan Bureau of Statistics, Large-Scale Manufacturing witnessed a considerable year-over-year contraction of 14.37% in May. For the country’s major industries during the just-ended FY23, this was the 9th consecutive month of deterioration. Without a focus on raising production or exports, the car industry’s future, along with that of many other industrial sectors, will remain gloomy.

A computer animation professional with over 23 years of industry experience having served in leading organizations, TV channels & production facilities in Pakistan. An avid car enthusiast and petrolhead with an affection to deliver quality content to help shape opinions. Formerly written for PakWheels as well as major publications including Dawn. Founder of CarSpiritPK.com