Car sales witnessed a 57% increase with 151,182 units during the last fiscal year of 2020-21, bouncing back from the low of 96,455 units in the pandemic-struck FY19-20 according to the data released by Pakistan Automobile Manufacturers Association (PAMA). Although automakers including FAW, Changan, Kia, United, and Regal are not members of PAMA and their sales data isn’t reflected in PAMA charts, accumulating figures of these automakers may add up another (approx) 20,000 units to the final tally.

Related: Car Sales Increased by 57% in FY2021

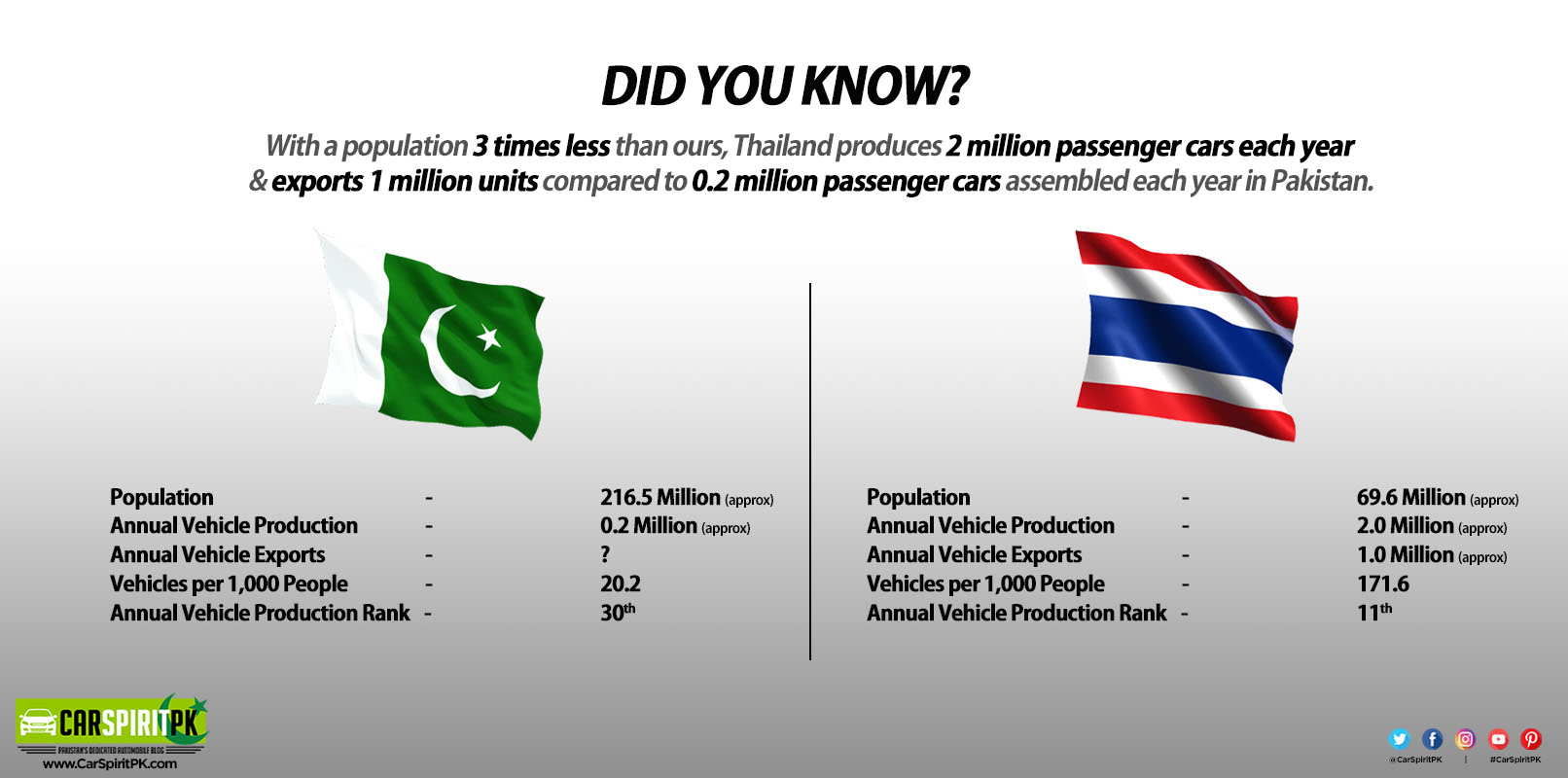

Despite the fact that Pakistan is the 6th most populous country in the world with a population of nearly 217 million, however, when it comes to automobile production, Pakistan pipettes out only around 0.2 million units annually (before the pandemic) and stands at 31st place among the vehicle producing countries with car exports next to nothing. For the sake of comparison, Thailand has a population of just 69 million, which is almost three times less than Pakistan, but it rolls out 2 million units annually while exporting a handsome 1 million units and ranks in 11th place in terms of volume among vehicle manufacturing countries.

In the recently announced Auto Policy 2021-26, Federal Minister for Industries and Production Mr. Khusro Bakhtiar said efforts are being made to increase automobile production to 350,000 units this year and increase their demand through incentives and other measures. However, there are certain reasons why automobile sales in Pakistan remain relatively lower than they should be.

Lack of Timely Deliveries

Even with such a minuscule annual production rate, car assemblers in Pakistan deliver the units to the customers several months after collecting bookings. In some cases this time period exceeds up to 8 months however despite previously operating in multiple shifts, assemblers continue to operate in single shifts citing the ‘slow market’ being the reason. Although the government says it has decided to impose penalties on auto assemblers who fail to deliver their vehicles within 60 days after taking the booking order, such measures even implemented in the past remain largely fruitless.

The Investor Mafia

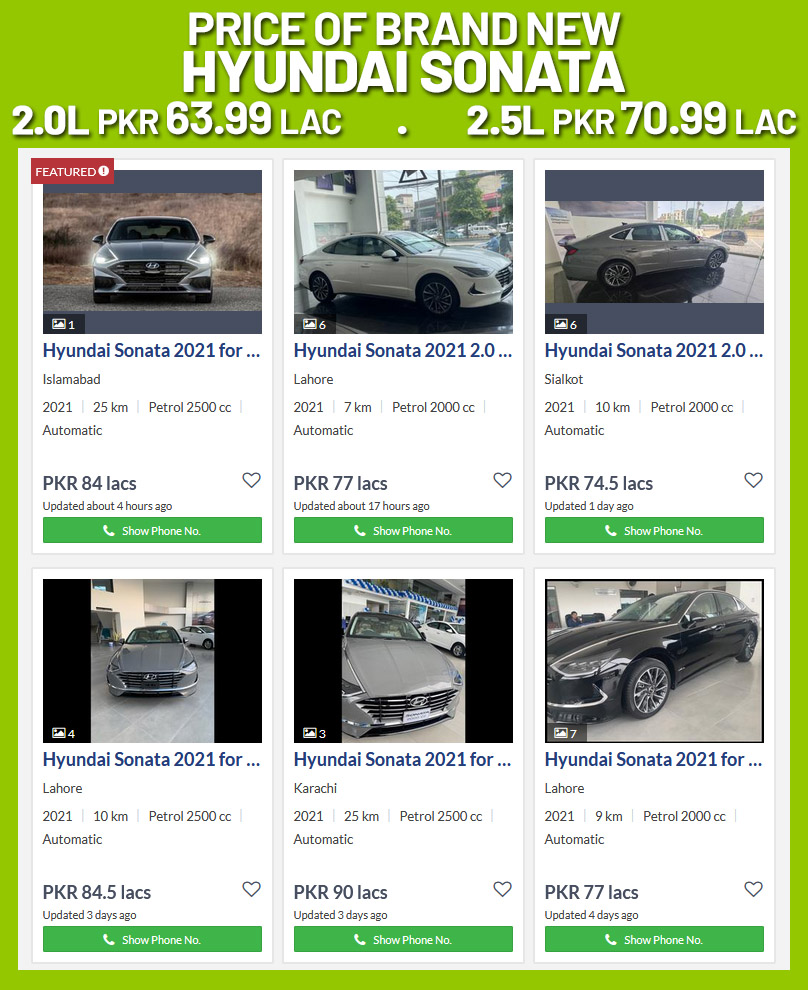

Another main hurdle in swift sales is the Investor Mafia. Whatever units are available for sale, they always end up going into the hands of dealers who intend to sell these cars in premium/ own money by charging up to 2 million above the invoice price as evident from the recent case of the Hyundai Sonata.

Related: Hefty Premium Despite Cars Sales Down by 53%

Although the government has taken certain measures such as the imposition of additional withholding tax (WHT) of up to Rs 200,000 on the sale of newly purchased vehicles if the first registration is not in the name of the person who originally booked the vehicle. But the practice of charging on-money is functioning in full swing. Dealerships are allegedly involved in allocating bookings to the investor since they used to get their ‘cut’ in the perk and since on- money is an undocumented income, it’s not even mentioned in the invoice.

Related: Toyota Land Cruiser J300 Buyers Banned From Reselling It Due To Security Concerns

In Japan, Toyota recently prevented the customers from reselling the new Land Cruiser J300 making it compulsory for the owners to sign an agreement to not resell the vehicle for at least 12 months after taking delivery of the LC300, but if they do, they won’t be allowed to buy another Toyota. It would be good if local assemblers or the government take such initiatives by barring the bulk or frequent purchasing of brand-new cars via tracing the CNICs instead of just charging additional WHT.

Lack of Mass-Market Buying Options

Although newcomers have poured in, as a result of Auto Policy 2016-21, automakers are focused on generating healthy profits rather than achieving volume production. Most companies have introduced super-expensive SUVs which don’t even represent 10% of the market as far as sales are concerned. However, the mass majority of car buyers are still dependent on whatever is offered by existing players.

Related: Why JDM Cars Are Considered a Threat to Local Assembled Ones

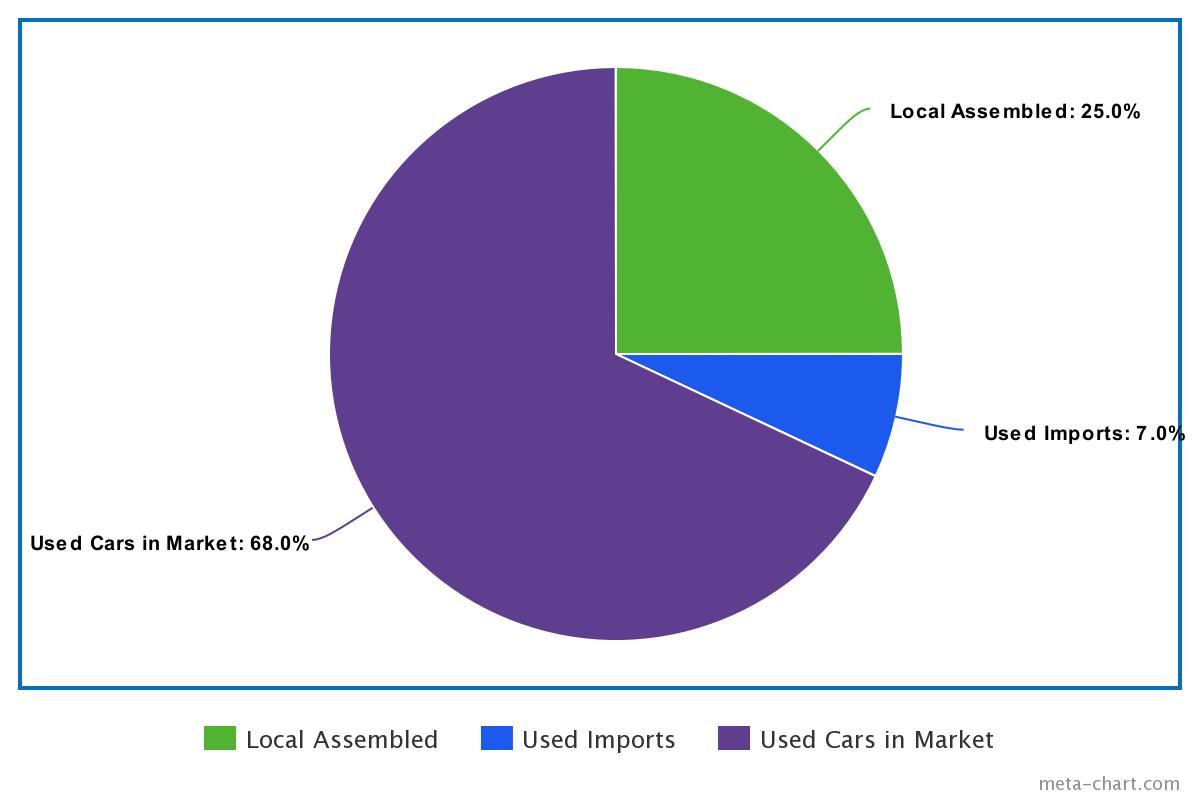

A few years ago, before the cap on Japanese used-car import was placed, more than 65,000 JDMs were being imported into the country which made up nearly 30% of new (locally assembled) cars sold in the market. Among these used imports, 90% of cars were those with 1000cc or below engines. According to sources, almost one million vehicles were sold in the market annually (before the pandemic in 2019), local assemblers supply about 250,000 vehicles, and about 70,000 are being (used) imports. While the rest of the public remains dependent on buying five to 20-year-old used cars from the market.

Higher Car Prices

Another hurdle is that the prices of locally assembled cars are much higher than what they offer, in terms of quality, safety & equipment. That’s one of the reasons why even 10+ years old used JDM cars with no warranty & spare part support is considered a threat to locally assembled brand-new cars.

Related: Rising Difference in Motorcycle & Car Prices & the Need to Fill the Gap

Furthermore, the price gap between 2-wheeler & 4-wheeler has sky-rocketed in recent years. For example, the price difference between an entry-level locally assembled 70cc 2-wheeler motorbike and an entry-level 800cc 4-wheeler (Suzuki Mehran) was hardly Rs 300,000 some 12/15 years ago. Today this gap is beyond Rs 1 million, which should give you an idea of how rapidly the prices of cars in our country have gone out of the reach of the masses. The largely populated middle class of the country or the first-time car buyers are forced to buy motorcycles, which are sold well above 1 million units a year. Families can be seen carrying 4-5 people (including children) on a motorcycle risking their lives just to go from point A to point B.

Although the government has reduced some taxes in the recent auto policy which has resulted in a slight decrease in prices of locally assembled cars. Still looking at the reduced prices, there isn’t a substantial difference for most buyers. Yes, car prices have come down but considering the amount of decrease, it might have become a little more attractive for those who could already afford it, but the prices are still largely out of the reach of the majority.

Related: Are Local Assembled Cars Only Expensive?

If the difference in prices of 2-wheelers & 4-wheelers is reduced to what it was a few years ago, sales of smaller cars would definitely increase. Who would want to risk the lives of his family members by carrying 4+ people on two wheels, when he can get a decent & safer mode of transportation for a reasonable amount of money?

Low Localization

The key factor behind higher prices is the inadequate localization achieved in the 4-wheel sector. Due to low localization in the case of cars, prices of automobiles (4-wheelers) are always vulnerable to forex fluctuations compared to motorcycles, which in the case of 70cc are almost fully localized now. Local auto parts vendors have also criticized vehicle assemblers over low localization and high prices. They pointed out various SROs especially 655(I)/2006 which have only benefited local assemblers instead of auto vendors and consumers.

Pakistan is Definitely a 200,000+ Vehicle Market

Pakistan definitely is a market worth more than 200,000 vehicles per annum. The only need is to ensure the right products are offered to the customers at the right prices. Plus the investor & ghost booking culture needs to be thoroughly eliminated. As per the new Auto Policy 2021-216, automakers will have to pay KIBOR+3% if the delivery of a vehicle isn’t made within 60 days of booking, however many stern measures needed to be taken in order to boost productivity rather than imposing a minuscule penalty.

Lastly, standards need to be uplifted so that vehicles can be exported to other regions. However considering the fact that we are way behind in terms of technology, emissions, safety features & equipment with even African markets taking a lead ahead of us, which countries can we tap into will be an interesting thing to ask. But before that, let’s focus on catering to the local demand by pulling up socks to timely deliver the vehicles to the rightful customers, shall we?

A computer animation professional with over 23 years of industry experience having served in leading organizations, TV channels & production facilities in Pakistan. An avid car enthusiast and petrolhead with an affection to deliver quality content to help shape opinions. Formerly written for PakWheels as well as major publications including Dawn. Founder of CarSpiritPK.com