For long Pakistan’s automobile market is dominated by only three players offering a very limited range of products, which often lacks variety in terms of specs & variants. Furthermore most products never rival another in terms of price or segment– redefining oligopoly.

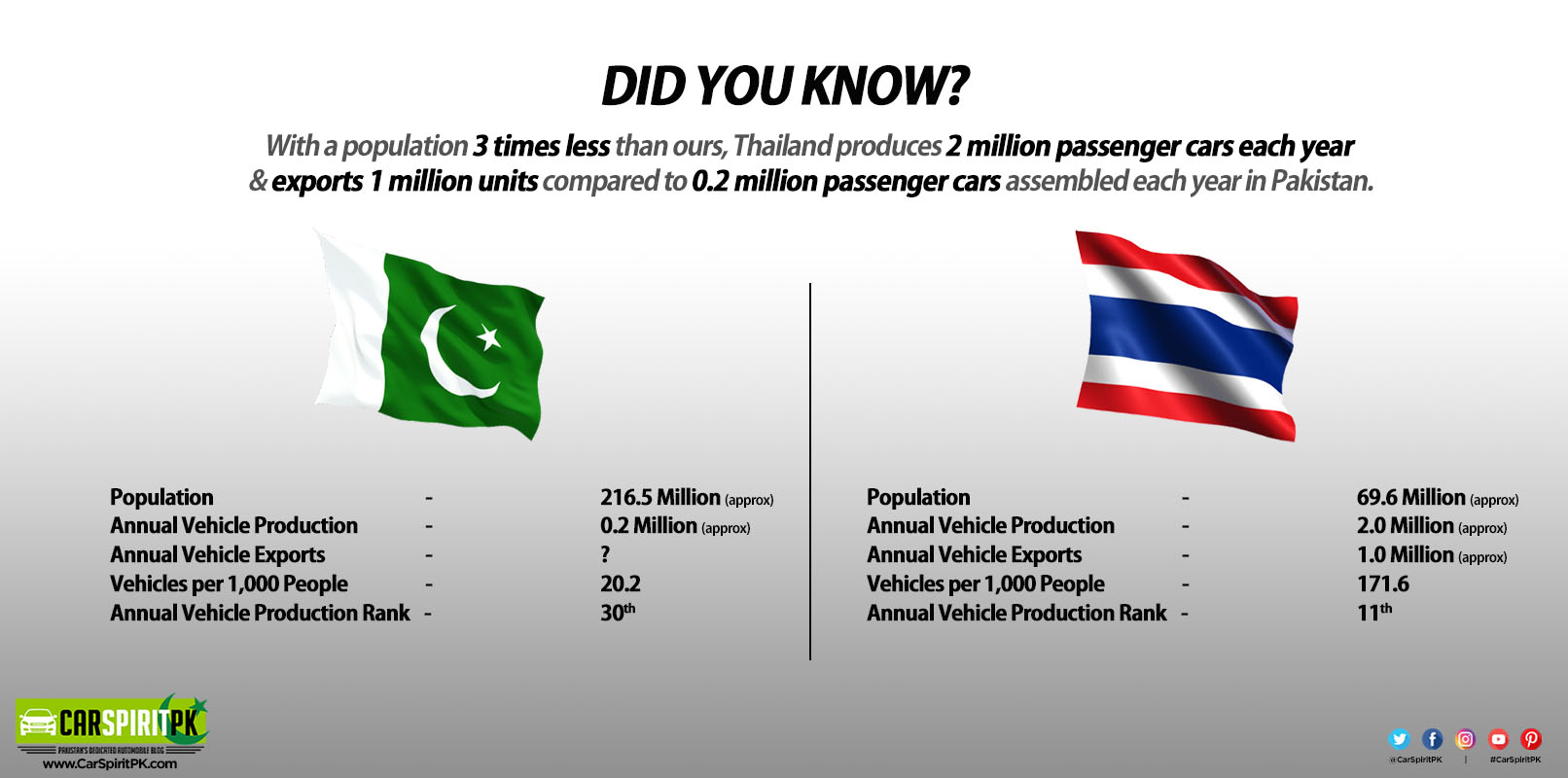

Despite the fact that Pakistan is the 6th most populous country in the world with a population nearing 217 million as of January 2020, however when it comes to automobile production, Pakistan pipettes out only around 0.2 million units annually and stands at 31st place among the vehicle producing countries. For the sake of comparison, Thailand has a population of just 69 million, which is almost three times less than Pakistan, but it rolls out 2 million units annually while exporting a handsome 1 million units and ranks at 11th place in terms of volume among vehicle producing countries.

Despite the fact that Pakistan is the 6th most populous country in the world with a population nearing 217 million as of January 2020, however when it comes to automobile production, Pakistan pipettes out only around 0.2 million units annually and stands at 31st place among the vehicle producing countries. For the sake of comparison, Thailand has a population of just 69 million, which is almost three times less than Pakistan, but it rolls out 2 million units annually while exporting a handsome 1 million units and ranks at 11th place in terms of volume among vehicle producing countries.

One of the main reasons is the preposterously high car prices due to which sales generally remain low. This is primarily because of large amount of taxes the government collects on each vehicle sale. An estimated 39% of vehicle’s price constitutes of various taxes, but then again leaving price aside, most of the models sold in Pakistan never match those offered in other parts of the world. Also during the last couple of decades, a vast majority of people opted for used imported cars since they believe they offer better quality & value for money compared to locally assembled cars.

Related: Are Local Assembled Cars Only Expensive?

Another factor is the lack of options offered by the local automakers. For example, there is a strong demand of a quality hatchback with automatic transmission in Pakistan but in a span of nearly 3 decades, Toyota never considered launching any of its hatchbacks here despite Vitz being extremely popular among used imports.

Pakistan introduced the Auto Policy in 2016 which has entered its 4th year already and although it’s a different debate on how effective the policy was to attract new players and generate competition in the sector, whatever we received in form of new options are targeted towards erroneous segments. The primary objective of the Auto Policy 2016 was to break the monopoly of 3 Japanese companies in the market, create competition between players, shorten the delivery period, eliminate own/ premium, bring down car prices and improve the quality of products offered to the customers. Ironically newcomers are either bringing ridiculously expensive options or remain focused towards commercial vehicles thus posing no threat to the existing Japanese trio.

Related: Remembering Cars from the Previous Decade

According to these companies, they don’t want to take ‘risk’ by offering products that compete against the existing options in the market, however they believe launching super-expensive products will return them decent profit margins. This perhaps can be a good strategy from business point of view, but on a larger scale Pakistan will continue to pipette out 0.2 million vehicles or maybe even less (due to declining sales), thus the newcomers won’t contribute much to the progress of local auto industry.

Related: Low Localization and the Need to Shift to EVs

Let us see what options the local automakers including existing as well as newcomers should have introduced here. Bear in mind these models offered in other parts of the world are considered extremely successful and have all the potential to generate healthy competition & even outdo the existing options in our market.

Toyota Vitz

For so many years, the Toyota Vitz has remained a prime choice for car buyers in Pakistan. The car is successful due to its attractive design, decent comfort & equipment, good fuel efficiency and off course, an automatic gearbox. Despite the fact that the car is not backed by warranty (since it comes in form of used imports), the Vitz for so many years has ruled the domestic automobile market. Ironically, Indus Motor Company (IMC) never considered introducing this car in Pakistan.

Daihatsu Mira

Daihatsu Mira is another successful car that appears in our market as used import. The success of Pak Suzuki’s Alto 660cc shows that there is a huge demand of fuel efficient small cars with automatic transmission in Pakistan. IMC did sold the 4th generation Cuore (Mira) between 2000 and 2012, and the car saw good success in its time due to a small engine and automatic gearbox option, however the company was forced to retire the car when Euro-II standards were enforced in 2012. Even if the company re-introduce the Mira with a Cuore nameplate off course, it can become a huge success and may give some tough time to the Pak Suzuki Alto.

Honda Brio

For the last 25 years Honda Atlas never considered introducing its smaller cars in Pakistan. Such as the new Brio hatchback, which is doing exceptionally well in Asian markets due to its remarkable fuel economy is one car that Honda must introduce in Pakistan.

Honda Fit

Fit is another popular hatchback by Honda that has just entered its 4th generation. Previous generation Fit models can be found on our roads among used imported cars. The Fit which is also known as Honda Jazz in global markets is popular due to its practicality, a thoughtful interior and good fuel consumption. It can be slotted below the Honda City in our market and can do well against the likes of Suzuki Swift- only if local automakers intend to compete against one another.

Suzuki Ciaz

Suzuki Ciaz is another car that should be introduced in Pakistan as a local assembled option. It has all the potential to stir the sedan market since it has already created plenty of troubles for the likes of Honda City across the border. Pak Suzuki offers a stripped-down pre-facelift model in Pakistan as a CBU import. The company had hinted to invest $430 million on development of its second plant (where Ciaz would be assembled) only if it was granted Greenfield incentives equivalent to what newcomers get. However since they failed to get the Greenfield status, the company is no longer willing to assemble the Ciaz locally.

Kia Rio

Kia-Lucky was among the first newcomers to begin their operations in Pakistan. The company launched Grand Carnival Luxury MPV, alongside Frontier K2700 commercial pickup, Sportage SUV and the globally retired 2nd generation Picanto hatchback for PKR 2.0 million for which they were largely criticized for. Although Kia-Lucky has been displaying the Rio on various occasions, they are yet to introduce the quality hatchback in Pakistan which can compete against the likes of Suzuki Swift here.

Kia Cerato

The award winning Cerato falls in the league of Honda Civic and Toyota Corolla Altis. Though the sedan has been spotted testing on local roads, Kia-Lucky is yet to reveal their plans regarding the launch of Cerato sedan in Pakistan.

Hyundai i10

The other newcomer Hyundai-Nishat has beaten Kia-Lucky by a huge margin when it comes to introducing cars that are far beyond the reach of masses. Having launched the ridiculously high priced Santa Fe SUV for One Crore Eighty Five Lac only, followed by Grand Starex Van (PKR 40.0 lac to PKR 52.0 lac) and Ioniq Hybrid (PKR 64.0 lac) as well as the locally assembled H-100 Porter commercial pickup, the company is yet to introduce its popular range of mass-market cars that are doing exceptionally well in key markets across the globe. Hyundai’s latest generation i10 hatchback is definitely one of them, and has the potential to create curtains for the likes of Suzuki Celerio (Cultus) in our market.

Hyundai i20

The i20 is another hatchback that can do well in our market and goes against the likes of Suzuki Swift. The i20 is currently in its 2nd generation which was about to be replaced by the 3rd gen model, however its scheduled debut was postponed due to the cancellation of 2020 Geneva Motor Show due to coronavirus concerns.

Hyundai Verna

The last in this list is the Hyundai Verna, the subcompact sedan that rivals against the likes of Honda City, Toyota Vios and Suzuki Ciaz. The Verna recently received a thorough facelift in Russia where the car is labeled as Solaris. The facelift will begin reaching other markets from the second half of this year. The award-winning Verna, if introduced in Pakistan can be a good alternative to locally available sedans.

What is your opinion regarding the introduction of the above mentioned cars in Pakistan, let us know with your comments.

A computer animation professional with over 23 years of industry experience having served in leading organizations, TV channels & production facilities in Pakistan. An avid car enthusiast and petrolhead with an affection to deliver quality content to help shape opinions. Formerly written for PakWheels as well as major publications including Dawn. Founder of CarSpiritPK.com