Pakistan introduced its first-ever dedicated Auto Policy in 2016 which enticed many new players to explore the Pakistani market. Consumers saw the availability of several new brands in a market that was long dominated by Suzuki, Toyota, and Honda only.

The primary objectives of the implementation of this policy were to 1) break the monopoly of three Japanese companies (aka Big 3) in the market, 2) generate healthy competition between players, 3) shorten the delivery period, 4) eliminate on-money/ premium, 5) increase localization, 6) bring down car prices and 7) improve the quality of products offered to the customers. Interestingly, however, even after more than 6 years since the policy got implemented, none of the aforementioned 7 points have been fulfilled.

Related: Remembering ‘Cars from the Previous Decade’

Not trying to sound too political, but car-buying options for the masses during the Musharraf regime without a definite auto policy were much more diverse compared to the current era. In the name of competition, newcomers who benefited from Greenfield incentives have mostly introduced super-expensive crossovers well beyond the reach of the masses while primarily targeting the elite class, ensuring thick profits in the least number of vehicles sold without the need to generate volumes & no intention for enhanced localization.

Back in those days, Chevrolet, Hyundai, Kia, Adam, Fiat, Mitsubishi, Proton, Nissan, Chery, Geely, and Gonow were all offering cars that were well within the reach of the masses and would directly compete against the existing options. Chevrolet Joy, Hyundai Santro, Kia Spectra, Fiat Uno, Mitsubishi Lancer, Nissan Sunny, and Chery QQ were some of the names that enjoyed a brief period of success but later all these brands faded into history ever since the dear democracy returned in 2008.

Although we have seen various bold claims by the responsible ones about the local auto industry to breach the known stagnant volumes. But it’s not yet able to go past the 250,000 units a year mark. This is mainly due to the fact that assemblers are not focused on achieving volumes rather they have their eyes on profit margins. That’s the reason why expensive products are being launched which cater to a very limited set of buyers with strong purchase power, whereas the masses are left at the mercy of existing options with little or no competition whatsoever.

Related: ‘Higher Localization’ Fails to Deliver Cheaper Vehicles

Smaller and more fuel-efficient cars are the need of the day as the country is battling with rising import bills and higher fuel costs. Instead what gets launched here are expensive crossovers with higher displacement engines with little or no focus on fuel economy. And it’s not just the case with newcomers, even existing automakers prefer introducing expensive options rather than diversifying their mass-market offerings.

For example, Indus Motor Company announced that it will introduce locally assembled Toyota hybrid cars in Pakistan next year. But the vehicle they will begin with will be the Corolla Cross hybrid which already cost more than Rs 10.2 million and as indicated by the company officials, will be available for around Rs 8 million once assembled locally. Even if the intention is to lessen the burden on fuel import bills or show care for the environment, which sounds nice from a marketing point of view, launching something that won’t even sell a dozen units a month is not the best of ideas.

Instead, why not launch the more affordable Raize which comes in smaller 1.0L turbocharged as well as hybrid powertrain options and will sell in much greater volumes compared to the overly expensive Corolla Cross? And can contribute towards achieving a greener environment in a much more efficient way.

Related: Why Should I Buy An Expensive New Crossover?

Similarly, Honda Atlas is on the verge of introducing the new HR-V which is expected to be priced higher than Rs 6.0 million. However, the company never considered tapping the smaller segment of the market with its popular kei cars which could compete against the Suzuki Alto 660cc or even the likes of the WR-V crossover which does well in right-hand drive markets.

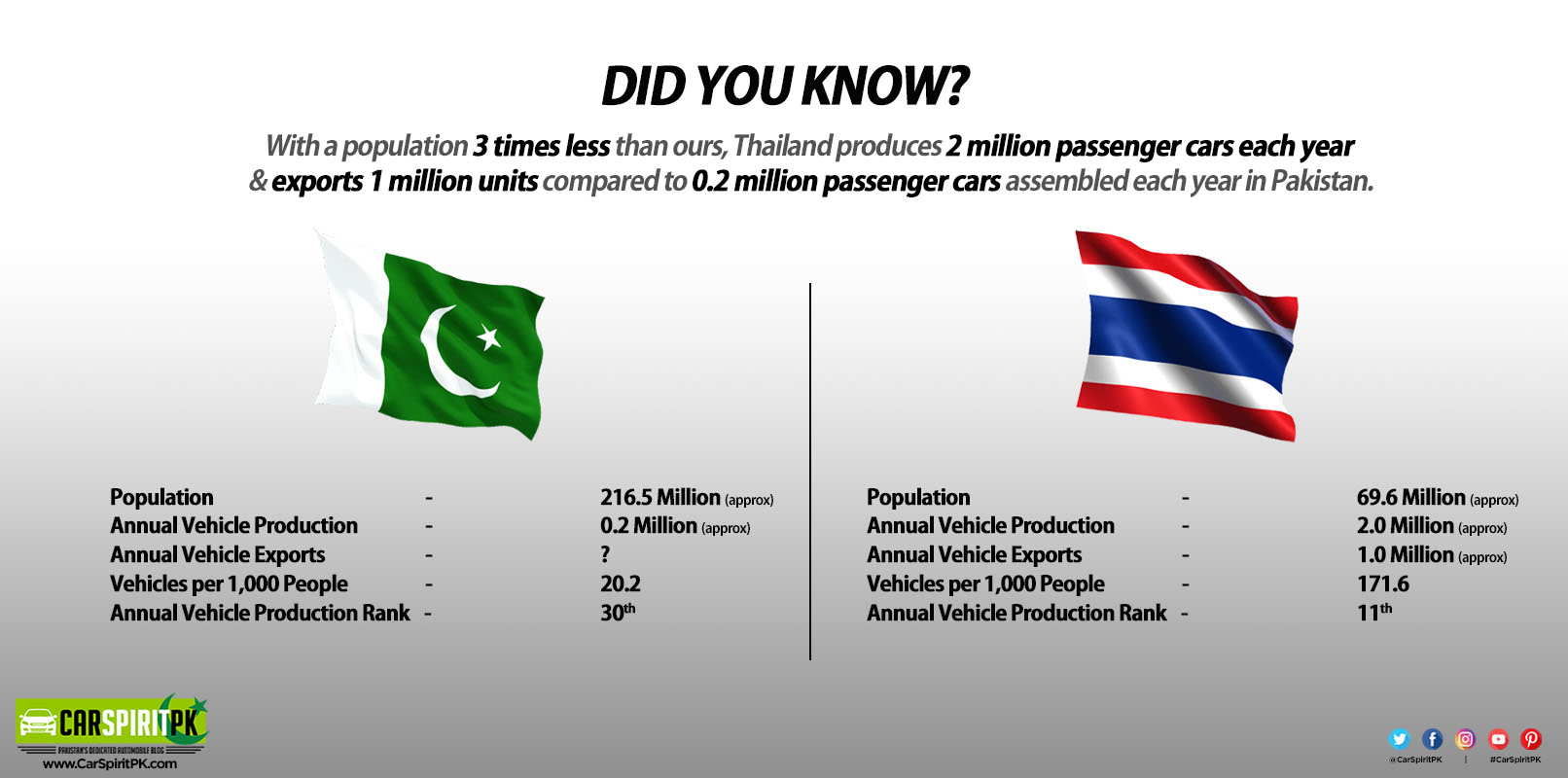

Despite the fact that Pakistan is the 6th most populous country in the world with a population of nearly 217 million, however, when it comes to automobile production, Pakistan pipettes out only around 0.2 million units annually (before the pandemic) and stands at 31st place among the vehicle producing countries with car exports next to nothing. For the sake of comparison, Thailand has a population of just 69 million, which is almost three times less than Pakistan, but it rolls out 2 million units annually while exporting a handsome 1 million units and ranks at 11th place in terms of volume among vehicle manufacturing countries.

The current range of locally assembled cars doesn’t meet the customer demands because of this the sales volumes are low. Products are not offered according to the purchasing power, and the local industry including new entrants is happy to launch super expensive vehicles in the toughest of economic times.

Related: A Market Where Cars Are Expensive Than Residential Property

For instance, Sazgar which was expected to launch mass-market D20 and X25 cars which it showcased in various auto shows, started off with a super-expensive BJ40 Plus SUV which is priced at Rs 92.95 lac. It also teamed up with GWM Haval and instead of more affordable and fuel-efficient H1 & H2 models like in South Africa, the company launched the H6 CUV priced at Rs 74.25 lac and Rs 84.99 lac for the 1.5T ad 2.0T models respectively. The story remains the same for other newcomers who rely on launching insanely expensive vehicles in a third-world market battling with depleting economic reserves and shirking purchase power of the masses.

Pakistan’s auto industry can only flourish when policies are made for the betterment of the industry, not for the benefit of those in charge. Making sure true & optimum localization is achieved, efficient capacity utilization of plants, and timely deliveries will generate volumes that in turn uplift the local auto sector in achieving respectable numbers.

Related: Economic Advisory Group Says Auto Policy is Damaging for Consumers

After all, for more than 35 years the industry has been an infant, and from the looks of it, will remain an infant with complete dependency on imports while needing government support in the shape of incentives every now & then.

A computer animation professional with over 23 years of industry experience having served in leading organizations, TV channels & production facilities in Pakistan. An avid car enthusiast and petrolhead with an affection to deliver quality content to help shape opinions. Formerly written for PakWheels as well as major publications including Dawn. Founder of CarSpiritPK.com